Many New South Wales property investors are becoming increasingly frustrated with the land tax being imposed on their properties as land values rise.

Macquarie Group Services is being approached by property investors to both restructure existing property holdings and in relation to future purchases for the purposes of reducing the incidence of land tax.

Land tax is having a significant effect on investment returns as well as cash flow and needs to be mitigated.

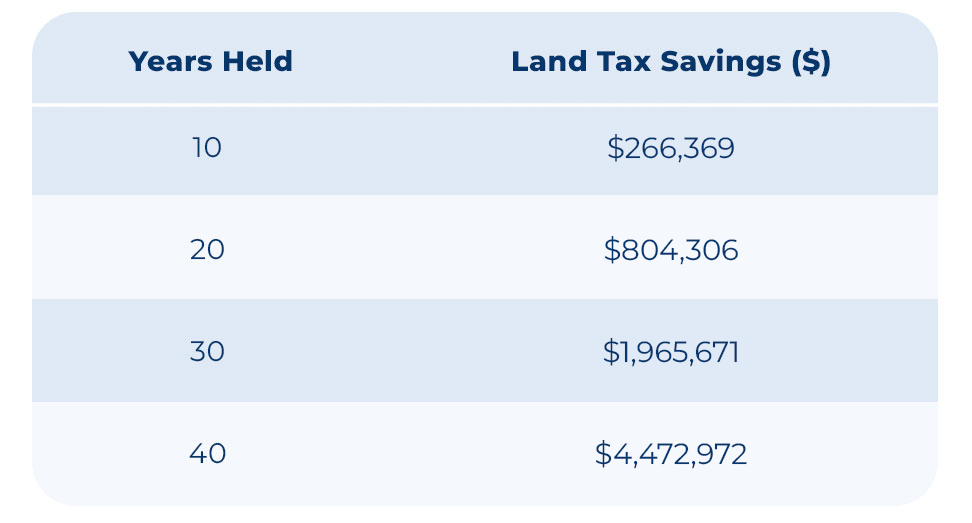

On the assumption that the current threshold of $1,075,000 (2025 Year) continues to 2027 and then the threshold is increased by 9% per annum the following savings could be achieved in relation to a single threshold:

Many enquires received relate to the existing holding of properties in New South Wales and the restructure of same to reduce the incidence of land tax. These include:

The above have different considerations in terms of income tax and duty and advice should be sought prior to entering any reconstruction concerning real property.

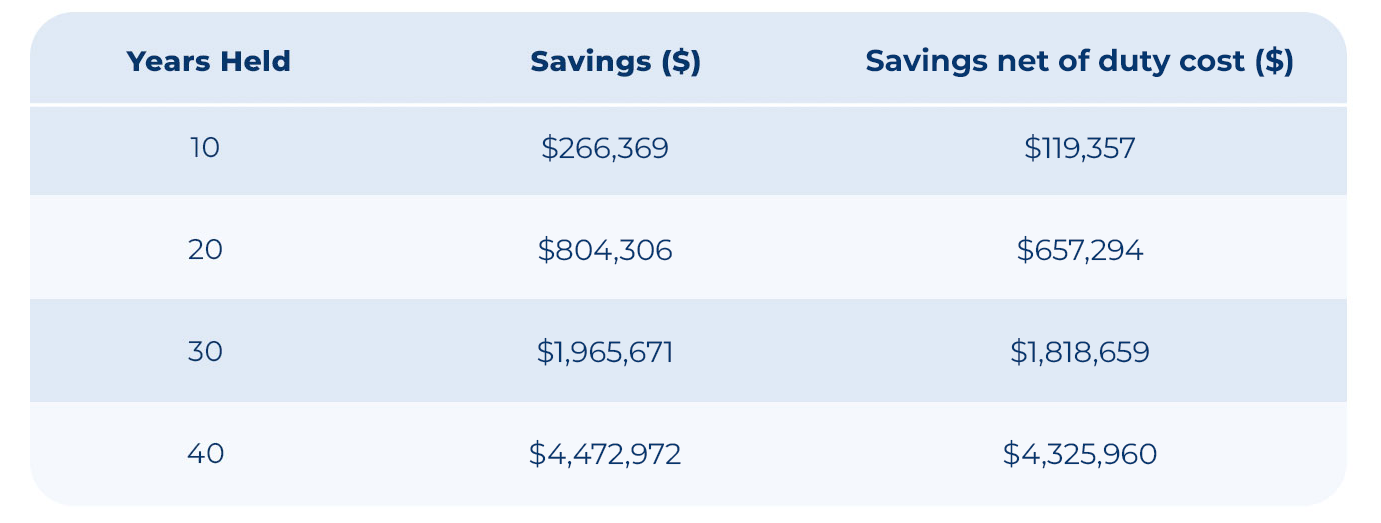

A discretionary trust owns a property in New South Wales with a land value of $1,075,000 and a market value of $3,000,000. No land tax threshold is being received.

If the trust is converted from a discretionary trust to a fixed unit trust duty of $147,012.00 would be payable.

The property would receive the land tax threshold, and the savings would be as follows:

The duty payment would be recouped within 7 years.

Note: The above assumes the land tax threshold will be increase by 9% per annum following the freeze ending in 2027 and the land value in the example increasing by 9% per annum.

The land tax threshold in New South Wales increased by an average of 10.15% per annum for the 10 years to 2024.

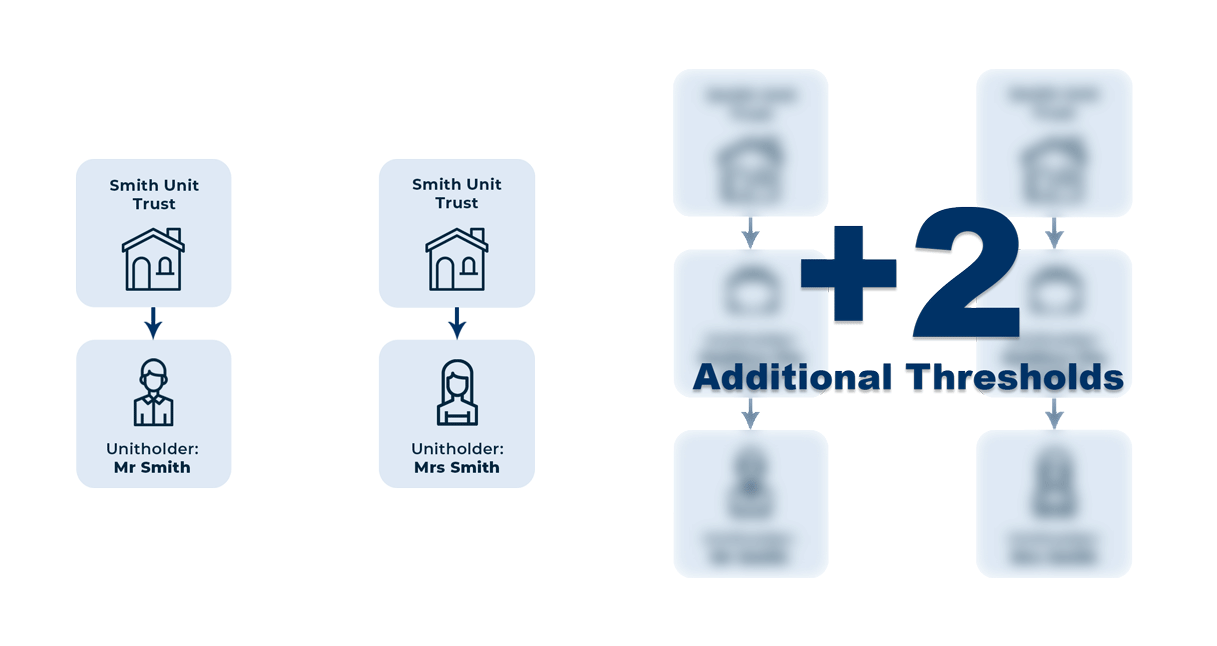

One of the main concerns when acquiring an investment property is the imposition of land tax. For example, careful structuring of the property acquisition will result in different outcomes. Assume a family acquired 4 investment properties on terms of a discretionary trust then no land tax threshold would apply.

With the proper structure in place the same family could achieve 4 thresholds that given the current thresholds would result in up to $68,800.00 in savings per annum.

A lot of investors are using structures that provide for either no threshold or 1 threshold regardless of the number of properties acquired. This means that up to $68,800.00 in savings is being lost.

Note: All investment properties, including residential, industrial and commercial, should be acquired on terms of a unit trust and in New South Wales a Land Tax Unit Trust.