Many New South Wales property owners are frustrated by the increasing burden of land tax are restructuring their properties to take advantage of multiple land tax thresholds.

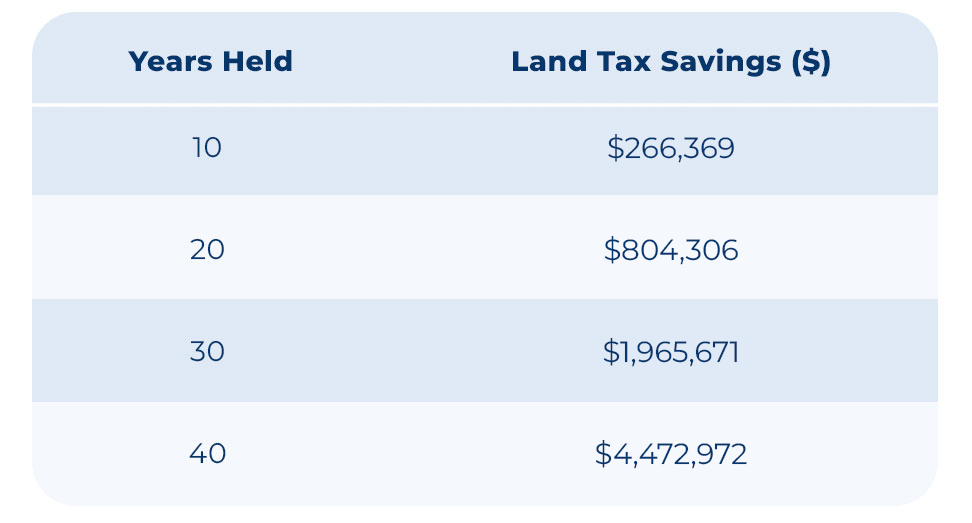

On the assumption that the current threshold of $1,075,000 (2025 Year) continues to 2027 and then the threshold is increased by 9% per annum the following savings could be achieved:

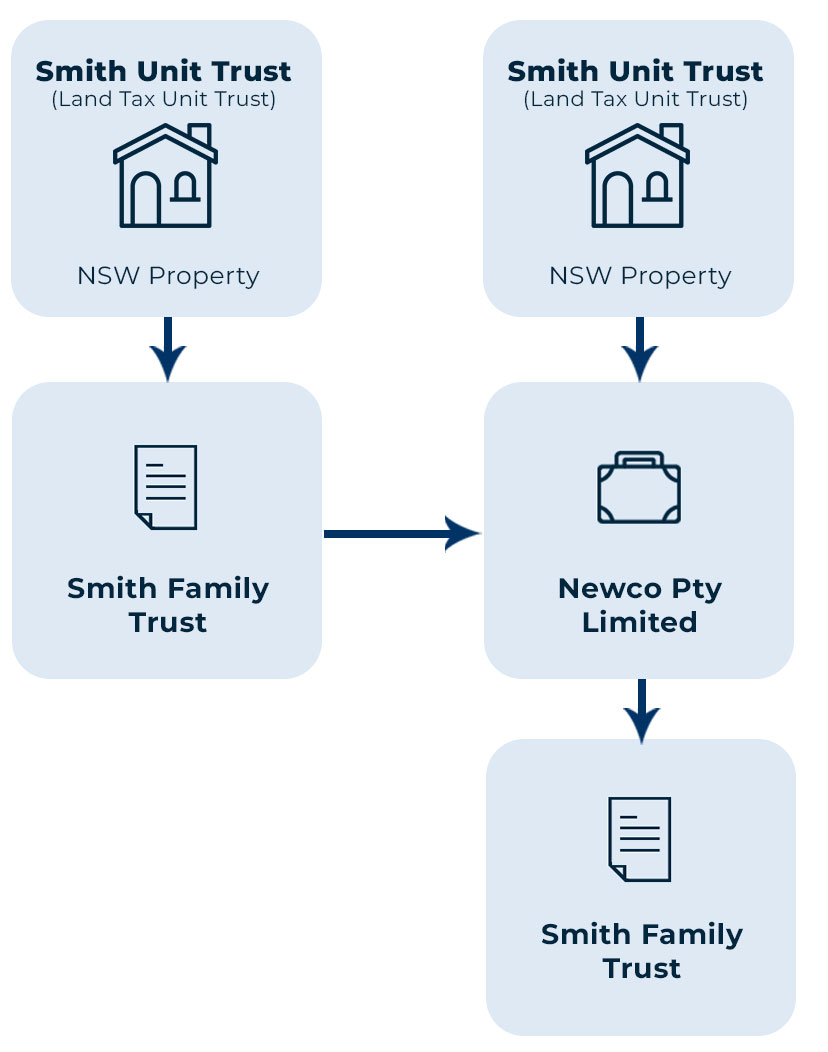

The strategy involves the corporate consolidation of a unit trust structure so that the unitholder becomes a constitutional corporation.

It means that the CGT discount is lost when the property is eventually disposed, however many are taking the position that the CGT discount is only important if and when they sell.

The quantum of the land tax savings over an extended period is starting to raise questions as to whether the CGT discount is worth the cost of the land tax.

A rental property held for 20 years will have up to an additional $804,306.00 land tax to pay if the threshold is lost.

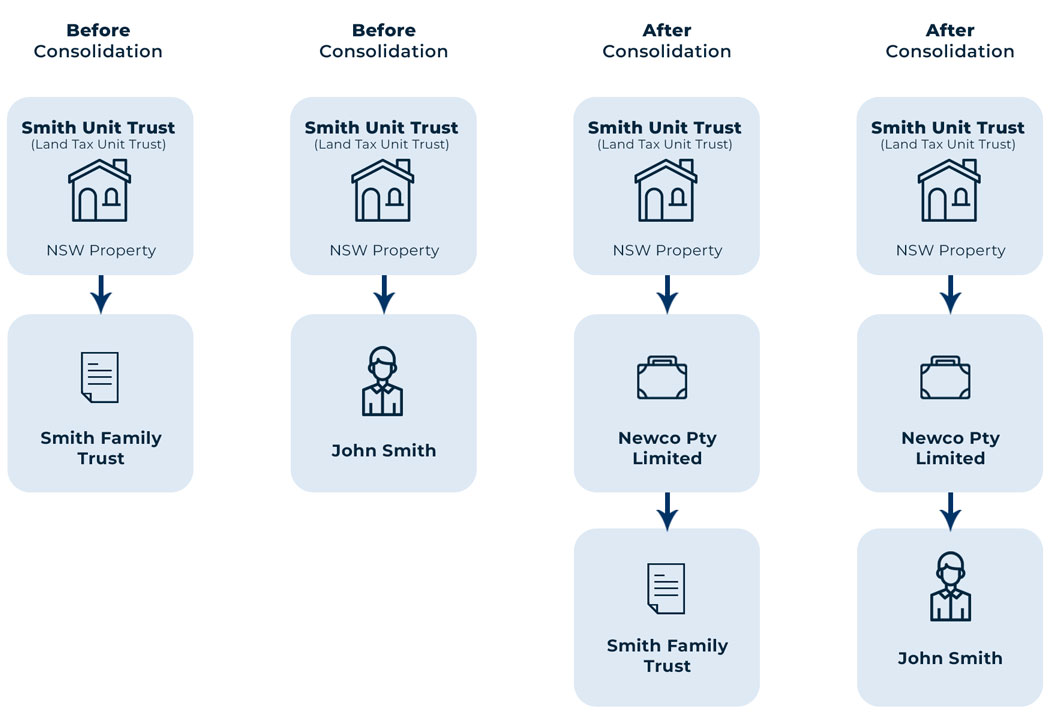

Where the property is held on terms of a unit trust then a corporate consolidation combined with a CGT rollover may be implemented so that an additional threshold is received. Where the unit holder of the unit trust is a family trust there is no threshold applied. By inserting a company between the unit trust and family trust a threshold will be received if the unit trust is a fixed trust, a corporate consolidation.

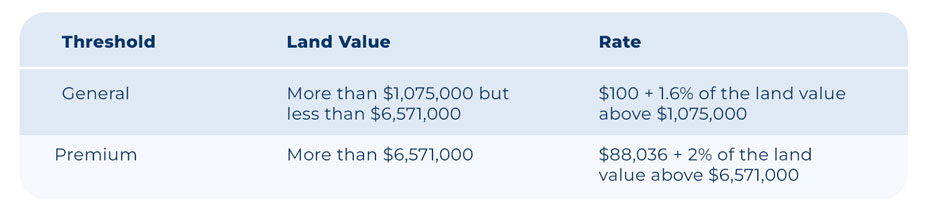

Since 1 February 2024 a corporate consolidation attracts a 10% duty cost if the property of the unit trust has a unencumbered value of $2,000,000 or more. For example if the property had an unencumbered value of $3million the duty payable on a corporate consolidation would be $14,740.90. If the land value was more than $1million the land tax saved would be $17,200 per annum.

NOTE: If the value of the property held by the unit trust is less than $2million then no duty would apply.

No CGT applies to the disposal of the units to the company if a rollover is selected.

The diagrams below represent the before and after consolidation position.

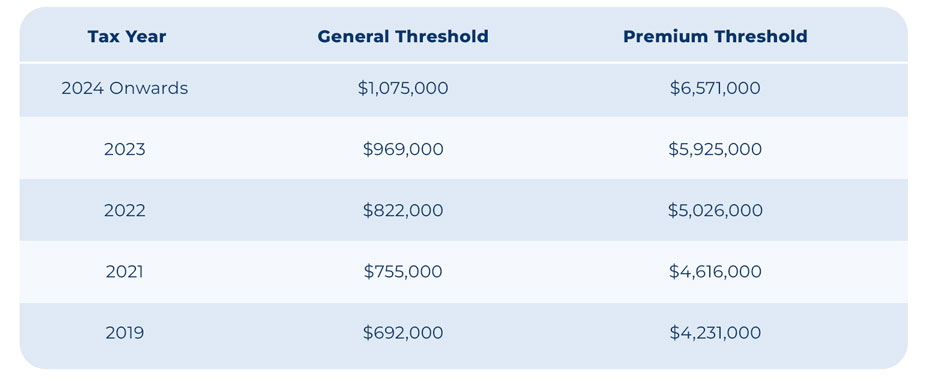

Historically, the land tax threshold changed every year.

Current threshold represents a $17,200 annual saving.

62P Tax threshold (LTMA56)

The tax threshold for the following land tax years is as follows--

(q) 2022--$822,000,

(r) 2023--$969,000,

(s) for a land tax year after the 2023 land tax year--$1,075,000.

62T Review of thresholds (LTMA56)

(1) The Treasurer must review the tax threshold and the premium rate threshold to determine whether the thresholds continue to be appropriate in the circumstances.

(2) The review must be undertaken by 1 June 2027.

(3) A report on the outcome of the review must be tabled in each House of Parliament as soon as practicable after 1 June 2027.