If your business is a company that owns 100% of another company, trust or partnership, consolidation is an option.

Key question

Does your business structure consist of a company that owns 100% of another company, trust or partnership?

Yes: you may be eligible to consolidate

No: you can't consolidate and the overview is not relevant to your business

Where a wholly-owned group does not choose to consolidate, the income tax system treats each company in the group as a separate entity. Taxing member entities separately means that each member must separately account for all intra-group transactions and debt and equity interests.

For business, this imposes extra compliance costs and may stand in the way of the most efficient business structure. From the community's perspective, the previous grouping provisions for wholly-owned groups provided opportunities for tax avoidance through artificial arrangements.

Key points

- Wholly-owned corporate groups may have the option of consolidating for income tax if they want all of their entities in their group to be taxed together.

- Consolidation is optional but irrevocable.

- The consolidated group operates as a single entity for income tax purposes, lodging a single income tax return and then paying a single set of pay as you go (PAYG) instalments.

- One in, all in. If a group consolidates, all of the head company's eligible wholly-owned subsidiaries are members.

- Most small businesses involve single entities and are not affected by the consolidation regime. Consolidation is not relevant to the business activities of individuals (such as sole traders).

The Australian Government has introduced consolidation to reduce compliance costs for business, remove impediments to the most efficient business structures and improve the integrity of the tax system.

Eligibility

The head company must:

- be an Australian resident (but not a prescribed dual resident) company

- not be a subsidiary member of a consolidated group or a group that is eligible to consolidate

- have at least some of its taxable income (if any) taxed at the general company tax rate.

A corporate unit trust or public trading trust that elects to be taxed like a company may be a head company.

A subsidiary member must:

- be a company, trust or partnership

- be wholly owned (either directly or indirectly) by the head company (disregarding finance shares that are a debt interest and up to 1% of ordinary shares that meet certain employee share scheme requirements)

- be an Australian resident (but not a prescribed dual resident)

- have at least some of its taxable income (if any) taxed at the general company tax rate (if a company).

Certain types of companies cannot be a head company or subsidiary member and certain types of trusts cannot be a subsidiary member. For example, superannuation funds generally cannot be a head company or subsidiary member.

A foreign-owned group of Australian resident subsidiaries that does not have a single resident head company may instead choose to consolidate by forming a multiple entry consolidated (MEC) group.

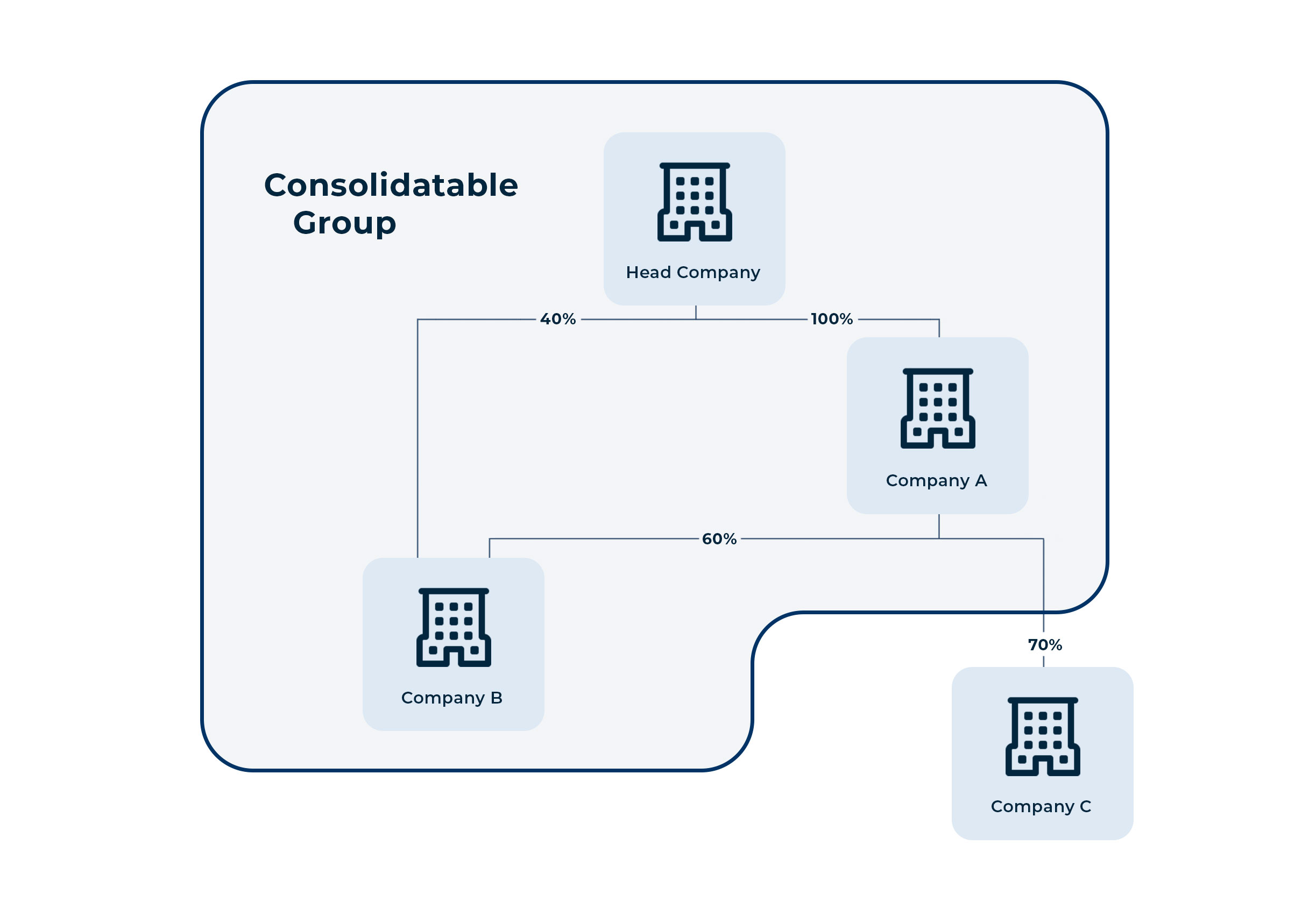

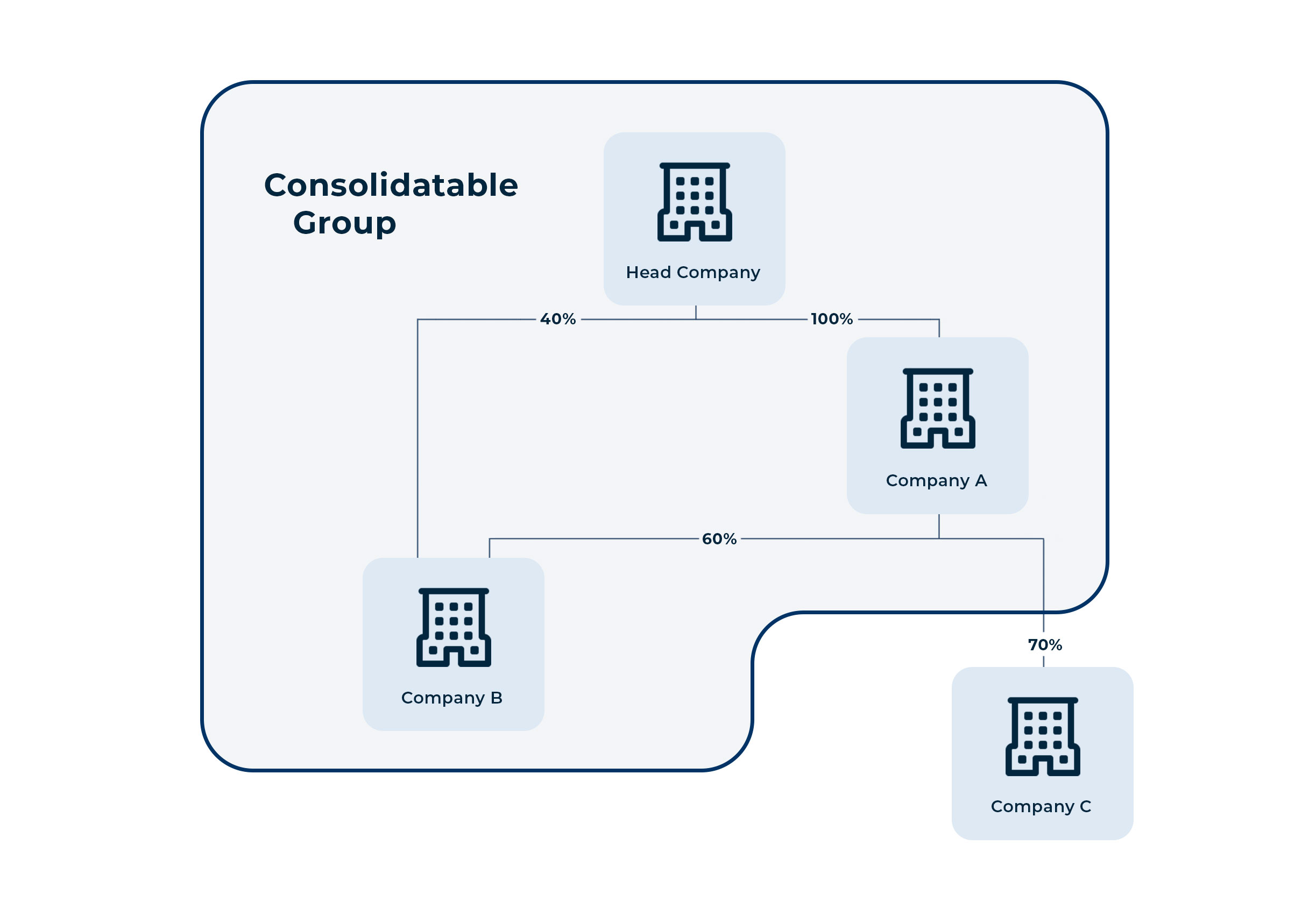

Figure 1

Figure 1 - As wholly-owned subsidiaries of the head company, companies A and B are subsidiary members of a consolidatable group. Company C is not a member as it is not wholly owned (directly or indirectly) by the head company.

Consolidation pathway

There is a pathway of key steps in choosing, forming and operating as a consolidated group:

Choosing

Consolidation is optional. A group needs to determine its eligibility, analyse the costs and benefits of consolidating, and choose whether and when to consolidate. The choice to consolidate is irrevocable once it is made.

Forming a consolidated group

Consolidating a group involves planning and implementing new systems and calculating a consolidated income tax position for the group as a whole.

Among other things, the head company needs to:

- determine asset values for joining subsidiaries

- transfer losses and calculate a utilisation rate

- transfer franking credits and foreign tax credits

- deal with the other tax attributes of the joining subsidiaries.

Operating as a consolidated group

Operating as a consolidated group requires the head company to, among other things:

- make a choice to form a consolidated group with effect from a certain date

- notify the ATO of its choice to consolidate in the approved form within the prescribed time

- calculate, report and pay the group’s PAYG instalments

- determine, report and make any balancing adjustments to meet the group’s annual income tax liabilities

- manage any ongoing income tax liabilities and supply income tax information to the ATO when required, and manage the entry and exit of subsidiary members, including notifying the ATO.

Costs and benefits

Costs

The consolidation process may initially be costly (software changes, obtaining information, accounting/legal fees).

Some aspects of consolidation may involve up-front compliance costs. For example, determining the asset values of joining subsidiaries involves complex calculations and may involve market-valuing assets. Similarly, the use of transferred losses by the head company may involve complex calculations and valuations. To help minimise these compliance costs, there are some short cut options available for determining asset values.

Benefits

- Intra-group transactions are ignored for income tax purposes

- Losses, franking credits and foreign tax credits are pooled

- Existing complex integrity provisions (such as those relating to cost base adjustments, loss deferral and debt forgiveness) do not apply to intra-group transactions

- Tax related impediments to group restructuring are reduced (for example, shares may be bought back into a group company without giving rise to a capital gain or loss, the liquidation of a member company will not trigger a deemed dividend, and assets can be moved between group entities without any formal rollover requirements)

- Ongoing compliance costs are reduced, as the group has a single income tax accounting period, self-assesses a single income tax liability, makes consolidated PAYG instalments and maintains only one franking account