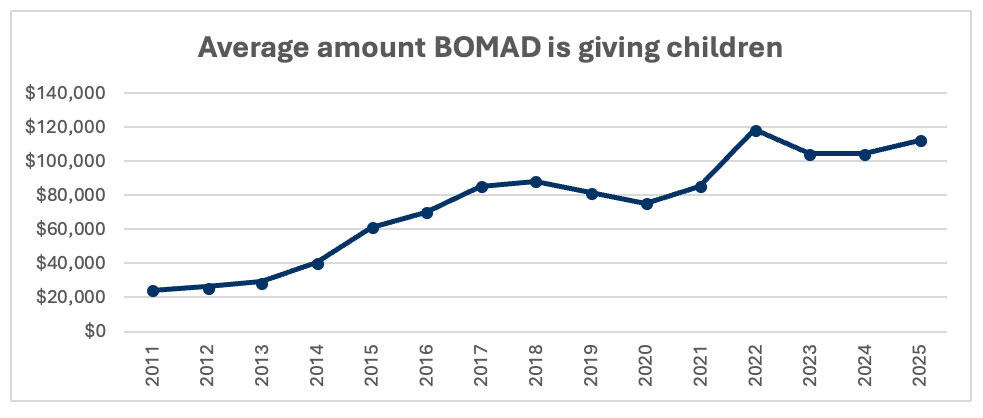

What is the Bank of Mum and Dad?

The "Bank of Mum and Dad" (BOMAD) is a nickname for parents, and sometimes grandparents ("Bank of Nan and Pop", BONAP), who help their kids financially, especially to buy a home. With house prices increasing, it's harder than ever for young people to save for a deposit. This support, worth about $3.5 billion annually, makes the Bank of Mum and Dad one of Australia's top mortgage lenders. But without proper planning, this help can backfire. Helping your child is a big deal, but it's risky without proper planning and structure. Parents who gift or lend money without clear terms often face unexpected issues, like losing their money through disputes or straining family relationships. A BOMAD Trust™ fixes this by protecting your money and keeping things fair.

Help Your Child Buy a Home with a BOMAD Trust™

A BOMAD Trust™ is like a secure piggy bank that lets you help one child, with for example a home deposit, while keeping your other kids' inheritance fair and your money safe. You gift money into the trust, which then lends it to your child with clear rules. This setup protects the money from risks like divorce and keeps it out of your estate, so there's no confusion later.

How does it work?

Once a BOMAD Trust™ is established, you gift the funds to the trust. The Trust then loans this amount, either interest free or at interest, to your child.

Having a properly documented loan in place between the trust and your child protects the funds from claim in divorce, by creditors, and more.

Initially the parents will be Principal Beneficiaries and Appointors, thus controlling the trust. The parents will also be the Trustees. On their passing or resignation, these roles will transfer to the child, giving them the control.

Our Comprehensive BOMAD Trust™ Package

For just $3,300 (incl. GST), Macquarie Group Services offers a complete BOMAD Trust™ package, expertly designed to secure your financial support for your child while protecting your family's future. This all-in-one solution contains every essential element required to achieve the maximum benefits of the BOMAD Trust™ we have specifically developed for parents lending money to their kids—Trust Deed, Deed of Loan, and Deed of Gift. They work together to deliver the full benefits and protections of a BOMAD Trust™.

Establishes the legal framework of the trust, defining its rules, beneficiaries, and controls of trustees and appointors. This document ensures the funds are managed according to your wishes, keeping them separate from your estate to avoid disputes among heirs

Formalizes the loan to the child, with flexible terms like optional interest and repayment dates. It protects funds from risks such as divorce or bankruptcy, ensuring clarity and preventing courts from treating the money as a gift

Records the funds gifted to the trust, safeguarding them from your estate and potential claims. This step is crucial for maintaining fairness across your family's inheritances

A BOMAD Trust™ avoids these pitfalls with clear, legal agreements that protect everyone.

Is it a loan or a gift? It's YOUR choice

The BOMAD Trust™ package offers parents flexibility in supporting a child, whether they intend the funds as a gift or expect repayment as a loan. The trust's loan can be tailored to meet your preferences and expectations.

Parents may choose no interest and no strict repayment schedule, meaning the child isn't required to make repayments. Upon the parents' passing, when the child gains control of the trust, they will be both the borrower and the trust's manager, allowing them to forgive the loan and erase the debt, effectively treating the funds as a gift. Alternatively, the loan can remain in place to protect the funds from claims, such as in a divorce.

Parents can specify a repayment date and include interest if desired, ensuring the funds are repaid to the trust, preserving assets for other beneficiaries or future use.

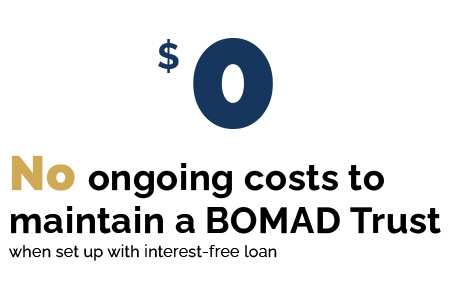

Set and forget

A BOMAD Trust™ package makes supporting your child financially both secure and hassle-free, with no ongoing costs when set up thoughtfully. By choosing an interest-free loan your BOMAD Trust™ incurs zero maintenance fees or annual expenses. Since the trust generates no income (e.g. interest), it requires no yearly tax returns, allowing you to "set and forget" while the trust continues to protect your funds from risks like divorce or bankruptcy. This simplicity ensures your generosity remains safeguarded without the burden of ongoing administration, preserving family harmony and your financial legacy.

Features That Make a Difference

Your BOMAD Trust™ can be tailored to fit your family. Here's some of what you can choose:

Control passes to your child after one parent passes, locking the trust from further changes

When a parent passes away, the surviving parent keeps control and can make changes to the trust until they pass or step down

Only your blood relatives can benefit from the trust, keeping the money safe from spouses or others

Incorporate an existing loan by moving it into the trust and receive all the benefits a BOMAD Trust™ offers

Benefits of a BOMAD Trust™

A BOMAD Trust™ offers a wide range of benefits when assisting your children financially.

Learn more about a BOMAD Trust™

For even more in-depth information about a BOMAD Trust™, we have put together a range of materials. Check out our full brochure and BOMAD Trust™ Factsheet. For a limited time we’re also making our comprehensive eBook "The Bank of Mum and Dad in Australia: From Loans to Legacies" free to download. For video content, our YouTube Channel is regularly updated with new explainers, interviews, webinars and more. To speak to someone about how a BOMAD Trust™ could be used in your situation, call or email us today.

Your Questions Answered

We're here to help, if you want to learn more about BOMAD, BONAP or Succession Trusts, call us on

(02) 9231 5111

and speak to one of our friendly staff

Get Started Today

To order this or any other Macquarie Group Services product, please create or sign in to your account here.