What is the Bank of Mum and Dad?

The Bank of Mum and Dad (BOMAD) refers to parents providing financial help—often loans or gifts—for their children's home deposits or purchases. In Australia, it's the 5th largest lender" with billions transferred annually. But without proper planning, this act can lead to unexpected complications. Common forms of help include direct cash gifts, interest-free loans, or co-signing mortgages. Over 60% of first-home buyers receive one of these kinds of assistance from the Bank of Mum and Dad as it bridges the affordability gap in a high-cost market, helping kids enter homeownership sooner.

What is a BOMAD (Bank of Mum and Dad) Trust?

A BOMAD (Bank of Mum and Dad) Trust is a legal structure parents can use to provide financial help to their children, often for buying property, in a way that offers a range of financial protections. Funds are placed in the trust and then a loan is made between the trust and the child. This allows parents to protect it in cases like divorce or financial difficulty. It can also offerestate planning advantages compared to a simple gift or loan.

Why This eBook Matters

As Australian property prices soar, more parents are stepping in to help their kids buy a home—creating the unofficial "Bank of Mum and Dad." But this generosity comes with risks that can affect your retirement, family harmony, and estate. Our eBook, "The Bank of Mum and Dad in Australia: From Loans to Legacies," equips you with expert insights to lend or gift wisely. Updated for the most current issues facing parents, it covers real-world strategies to turn your support into a secure legacy.

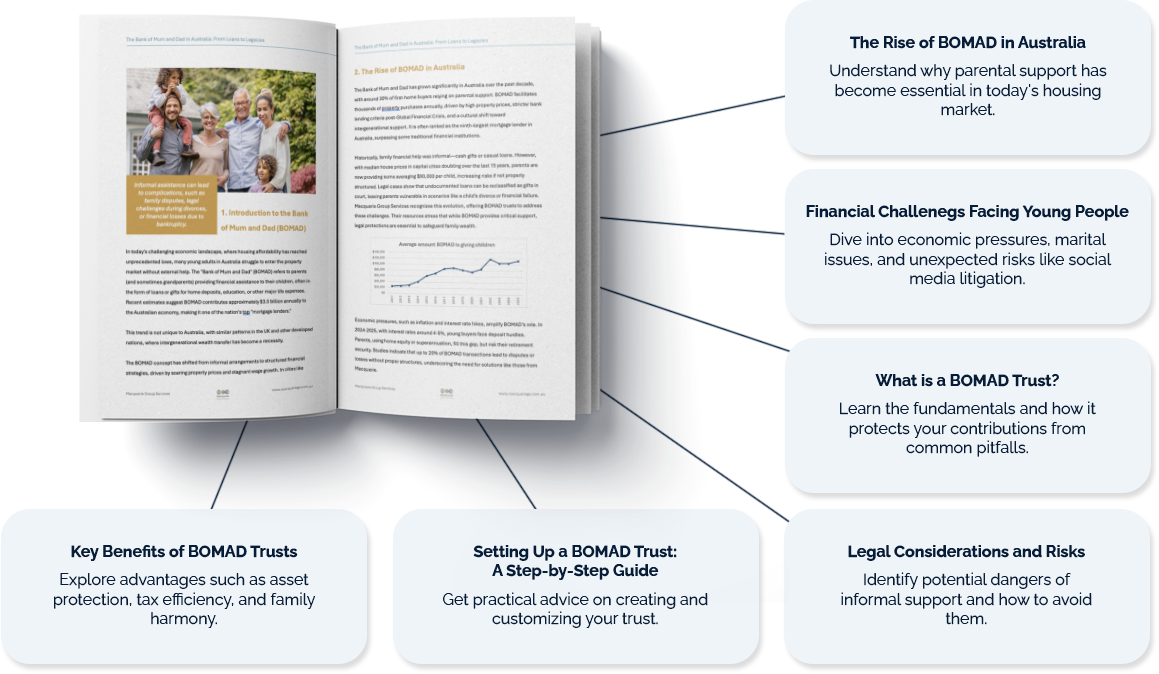

What's Inside the eBook?

Learn about key issues surrounding the Bank of Mum and Dad. In the book we explore the growing role of parental financial support in Australia amid rising property prices and the challenges young people face, including financial hurdles, social media defamation risks, and increasing divorce rates. You'll gain insights into the basics of trusts and their key roles, discover what a BOMAD Trust™ is and how it operates to safeguard your wealth. With practical guidance on setup, legal risks, real-life case examples of parents lending or gifting funds, and estate planning concerns, the eBook contains everything you need to confidently navigate gifting or lending as the Bank of Mum and Dad.

Get Started Today

A BOMAD Trust™ from Macquarie Group Services is the smart, safe way to support your child to buy a property. What better bank than the Bank of Mum and Dad?

We're here to help, if you want to learn more about BOMAD, BONAP or Succession Trusts, call us on

(02) 9231 5111

and speak to one of our friendly staff