Help Your Grandchild Buy a Home with a BONAP Trust™

At Macquarie Group Services, we know that as grandparents (Nans and Pops), you want to give your grandchildren a strong start in life. A BONAP Trust™, or Bank of Nan and Pop Trust, is a secure way to provide funds for your grandchildren's property or other goals, with their parents able to play a key role in managing the support. This plan ensures your generosity is protected and shared across generations, creating a lasting family bond.

A BONAP Trust™ allows you to place funds into a safe structure to help your grandchildren purchase property. Like a BOMAD Trust™, which helps parents support a child directly, a BONAP Trust™ adds an extra layer: after you pass, control moves to their parents as appointors and principal beneficiaries before the funds reach your grandchildren. This gives you confidence that your gift will be handled with care by those you trust.

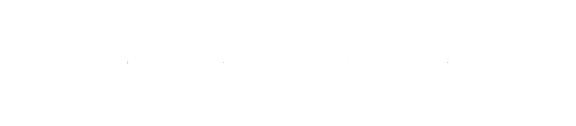

Control of the Trust

Why choose a BONAP Trust™

More than just helping with a deposit - BONAP Trust™ VS Direct Help

Unlike giving money straight to your grandchildren, a BONAP Trust™:

as a managing layer, overseeing funds before they reach your grandchild

from a grandchild's debts, divorce, creditor claim and even Family Provisions Act claims

By giving your grandchild and their parents, clear roles which avoids confusion and potential conflicts after you're gone

to use when your grandchild needs it, unlike delayed or informal handouts or direct gifts

unlike direct assistance which risks being lost or disputed in a range of different circumstances

Direct assistance might vanish due to unforeseen problems, while a BONAP Trust™ keeps your gift safe and structured.

How does it work?

Once a BONAP Trust™ is established, grandparents gift funds to the trust, which then lends the amount to the grandchild, either interest-free or with interest.

A formal deed of loan protects the funds from claims in cases of divorce, bankruptcy, or other risks.

Initially, grandparents control the trust as trustees and appointors. Upon their passing or resignation, control typically transfers to the grandchild's parents or the grandchild, based on your chosen setup.

Our comprehensive Bank of Nan and Pop Package

We make it easy, guiding you through the process to tailor the trust for your family's needs.For just $3,300 (incl. GST), Macquarie Group Services offers everything you need to set up a BONAP Trust™:

Establishes the legal framework of the trust, defining its rules, beneficiaries, and controls of trustees and appointors. This document ensures the funds are managed according to your wishes, keeping them separate from your estate to avoid disputes among heirs

Formalizes the loan to the child, with flexible terms like optional interest and repayment dates. It protects funds from risks such as divorce or bankruptcy, ensuring clarity and preventing courts from treating the money as a gift

Records the funds gifted to the trust, safeguarding them from your estate and potential claims. This step is crucial for maintaining fairness across your family's inheritances

Learn more about a BONAP Trust™

For even more in-depth information about a BONAP Trust™, we have put together a range of materials. Check out our full brochure and BONAP Trust™ Factsheet. For a limited time we’re also making our comprehensive eBook "The Bank of Mum and Dad in Australia: From Loans to Legacies" free to download. For video content, our YouTube Channel is regularly updated with new explainers, interviews, webinars and more. To speak to someone about how a BONAP Trust™ could be used in your situation, call or email us today.

Your Questions Answered

We're here to help, if you want to learn more about BOMAD, BONAP or Succession Trusts, call us on

(02) 9231 5111

and speak to one of our friendly staff

Get Started Today

To order this or any other Macquarie Group Services product, please create or sign in to your account here.