Many people end up owning their main residence either following advice or sometimes moving into a property that was previously an investment property.

An exemption from land tax is available where a property is owned by a trust as long as certain conditions are met. MGS Private has been involved in obtaining many exemptions where the main residence is held in a trust.

[Email received from Revenue NSW]

The principal place of residence exemption has been granted from 18 November 2024 as the trustee is a natural person and the only unitholder is also a natural person who uses and occupies the land as their principal place of residence.

The conversion to attract the principal place of residence exemption does not attract CGT, however this needs to be confirmed on a case by case basis.

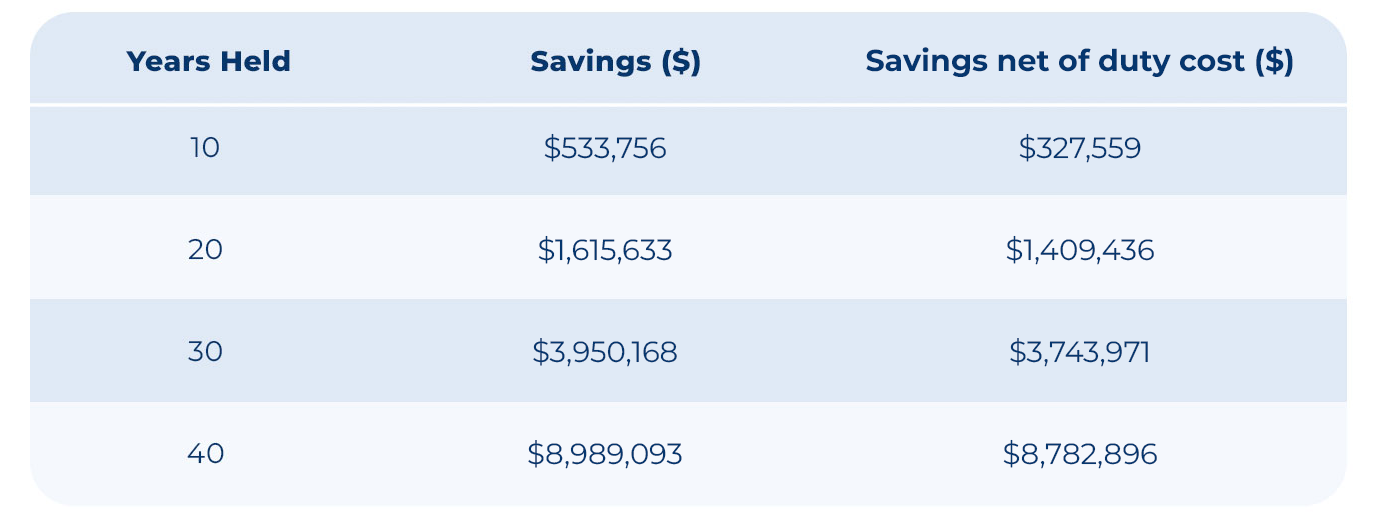

A discretionary trust owns a property in New South Wales with a land value of $2,000,000 and a market value of $4,000,000. It is a main residence. No land tax threshold is being received.

If the trust is converted from a discretionary trust to a fixed unit trust duty of $206,197.00 would be payable.

The property would receive the land tax exemption, and the savings would be as follows:

The duty payment would be recouped within 5 years.

Note: The above assumes the land tax threshold will be increase by 9% per annum following the freeze ending in 2027 and the land value in the example increasing by 9% per annum.

The land tax threshold in New South Wales increased by an average of 10.15% per annum for the 10 years to 2024.

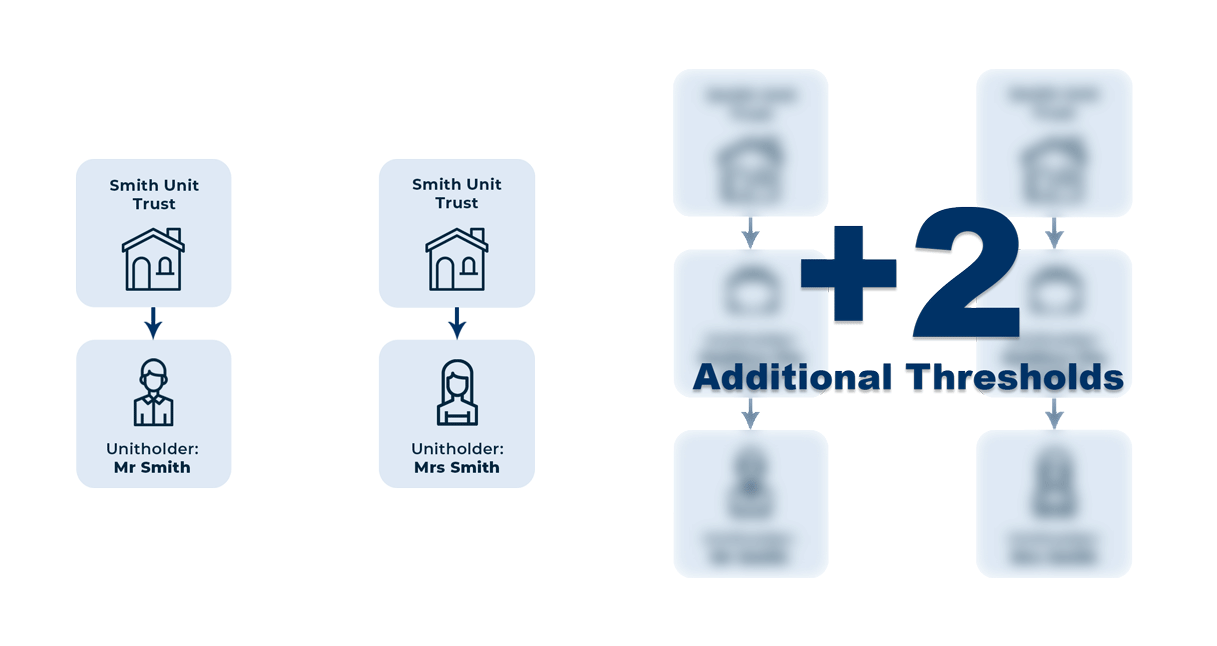

One of the main concerns when acquiring an investment property is the imposition of land tax. For example, careful structuring of the property acquisition will result in different outcomes. Assume a family acquired 4 investment properties on terms of a discretionary trust then no land tax threshold would apply.

With the proper structure in place the same family could achieve 4 thresholds that given the current thresholds would result in up to $68,800.00 in savings per annum.

A lot of investors are using structures that provide for either no threshold or 1 threshold regardless of the number of properties acquired. This means that up to $68,800.00 in savings is being lost.

Note: All investment properties, including residential, industrial and commercial, should be acquired on terms of a unit trust and in New South Wales a Land Tax Unit Trust.