Many New South Wales property investors are becoming increasingly frustrated with the land tax being imposed on their properties as land values rise.

Macquarie Group Services is being approached by property investors to both restructure existing property holdings and in relation to future purchases for the purposes of reducing the incidence of land tax.

Land tax is having a significant effect on investment returns as well as cash flow and needs to be mitigated.

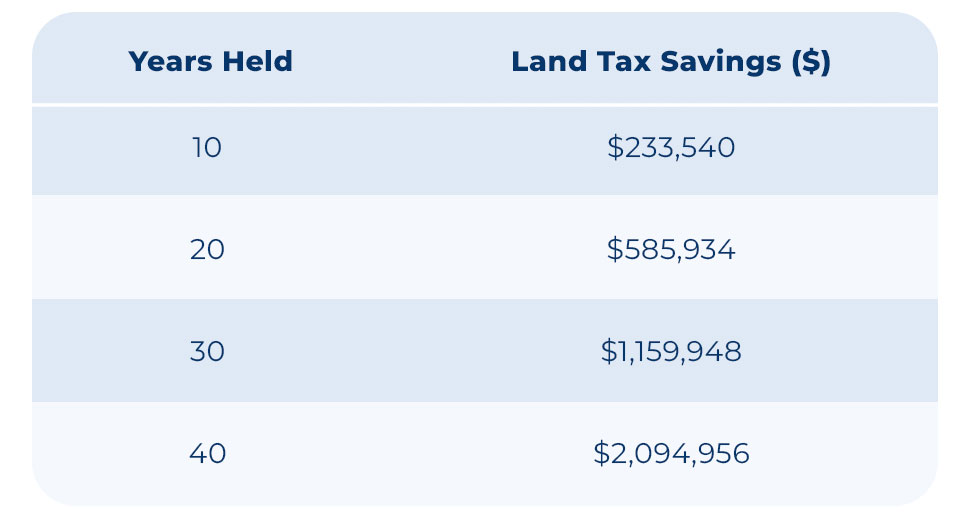

On the assumption that the current threshold of $1,075,000 (2025 Year) continues to 2027 and then the threshold is increased by 5% per annum the following savings could be achieved in relation to a single threshold:

Many enquires received relate to the existing holding of properties in New South Wales and the restructure of same to reduce the incidence of land tax. These include:

The above have different considerations in terms of income tax and duty and advice should be sought prior to entering any reconstruction concerning real property.

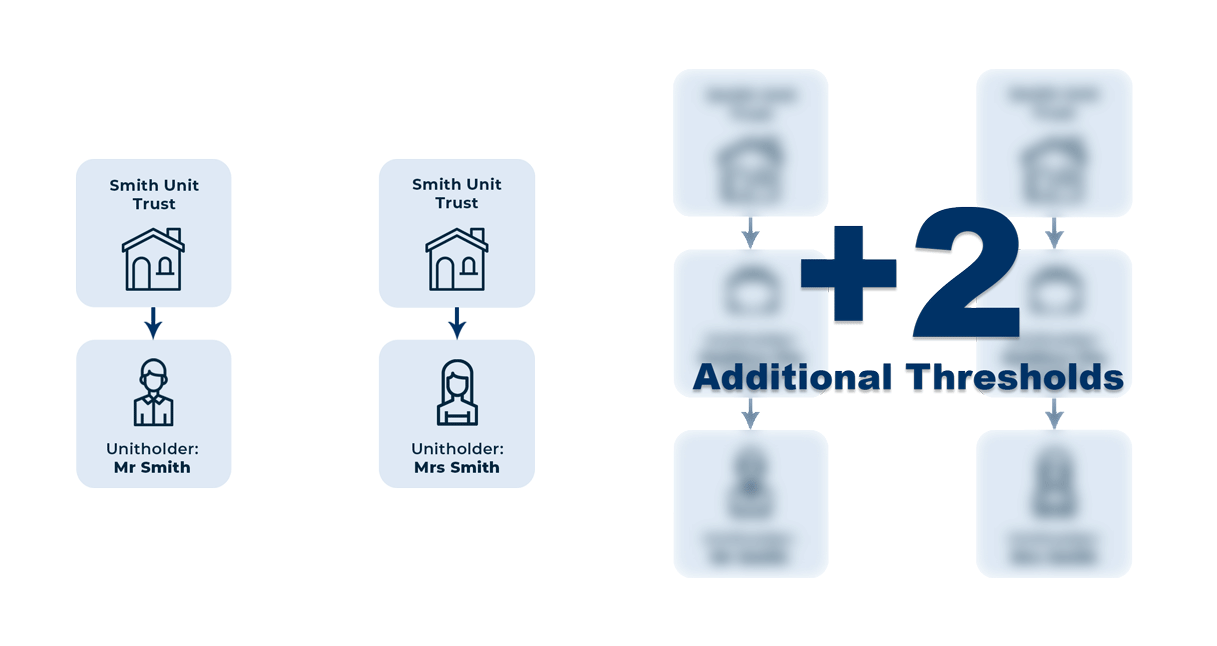

One of the main concerns when acquiring an investment property is the imposition of land tax. For example, careful structuring of the property acquisition will result in different outcomes. Assume a family acquired 4 investment properties on terms of a discretionary trust then no land tax threshold would apply.

With the proper structure in place the same family could achieve 4 thresholds that given the current thresholds would result in up to $68,800.00 in savings per annum.

A lot of investors are using structures that provide for either no threshold or 1 threshold regardless of the number of properties acquired. This means that up to $68,800.00 in savings is being lost.

Note: All investment properties, including residential, industrial and commercial, should be acquired on terms of a unit trust and in New South Wales a Land Tax Unit Trust.