Check that you have a court order or formal agreement that qualifies for the relationship breakdown CGT rollover.

When 2 people separate or divorce, assets transferred between them usually qualify for the relationship breakdown rollover.

This means capital gains tax (CGT), which normally applies when ownership of an asset changes, is deferred. CGT will apply to the person who received the asset when they later dispose of it.

The relationship breakdown rollover of CGT only applies if assets are transferred under a court order or other formal agreement.

If the rollover applies to an asset, you must use it.

For a summary fact sheet with common scenarios about CGT and marriage or relationship breakdown and real estate transfers that you can download as a PDF, see Marriage or relationship breakdown and real estate transfers.

The rollover applies to the transfer of assets (or other CGT events) that result from one of the following:

From 1 July 2009, the marriage or relationship breakdown rollover is available to same-sex couples.

For transfers that happen because of a binding financial agreement or a binding agreement used by a separating couple, the rollover only applies if, at the time of the transfer:

The rollover does not apply if you and your spouse divide assets under a private or informal agreement.

In this case:

The transaction is treated as if it was made at market value if both the following apply:

The rollover applies to CGT events in which the transferor:

There is no rollover for the transfer of trading stock.

If an asset is transferred under a contract, the CGT event happens when the contract is entered into.

If there is no contract, the CGT event happens when the change of ownership of the asset occurs.

Transfers made because of a court order or arbitral award are not made under a contract. Therefore, the CGT event does not happen until the asset is transferred.

If CGT event B1 applies, the event happens when use of the asset passes to the transferee spouse.

If an asset is transferred to you under a relationship breakdown rollover, you do not pay capital gains tax (CGT) until you later dispose of it.

When you dispose of a rollover asset, you calculate your CGT as though you had owned it since your former spouse acquired it.

To calculate your capital gain or loss on the asset, take its capital proceeds (usually the amount you sold it for) and subtract:

If the asset was acquired by your spouse before 20 September 1985, it is not subject to CGT. Any subsequent major capital improvements to the asset are subject to CGT.

To be eligible for the 50% CGT discount on an asset, you must have owned it for 12 months or more.

When working out how long you owned the asset, you include the period your former spouse owned it.

A CGT asset of a small super fund (one with no more than 6 members) can be transferred to another complying super fund under the relationship breakdown rollover. The consequences of the rollover are the same as for other transfers between spouses.

This allows spouses in a small super fund to separate their super arrangements on the breakdown of their relationship without any CGT liability.

If a company or trust transfers a CGT asset to a spouse, the cost base and reduced cost base of interests in the company or trust need to be adjusted They are reduced in value by an amount that reflects the fall in their market value from the transfer of the CGT asset.

In some circumstances, the transfer of an asset from a company to a spouse who is a shareholder or an associate of a shareholder may be a dividend under Division 7A. In this case CGT does not apply.

If the transferor is a controlled foreign corporation or a foreign trust, there are special rules for working out the capital gain or loss for a subsequent CGT event.

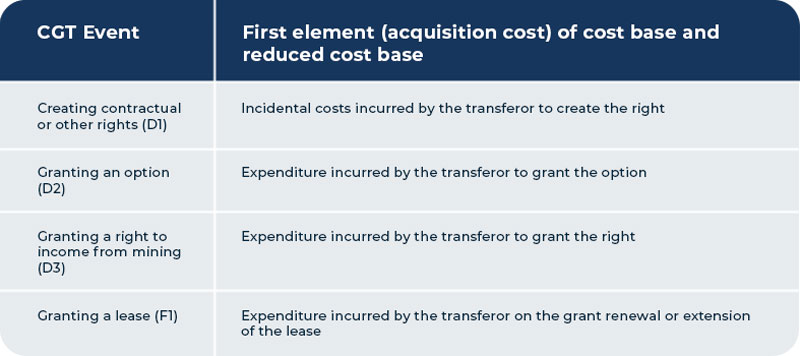

Your spouse (or a company or trustee) may create an asset in your favour.

For CGT purposes you acquire the asset at the time specified by the CGT event. For example, for CGT event D1, you acquire the asset at the time you enter into the contract or, if there is no contract, the time the right is created.

When you sell a property that transferred to you under the relationship breakdown rollover, you may be eligible for the main residence exemption from capital gains tax (CGT).

You need to consider how you and your former spouse used the property during your combined period of ownership

Under the relationship breakdown rollover, there was no capital gain or loss for CGT purposes when your former spouse's share of the property transferred to you.

CGT was deferred, or 'rolled over', until you dispose of the property.

If the property was the main residence of you or your former spouse, you can generally claim a full or partial exemption from CGT when you dispose of it.

You are entitled to the full main residence exemption if the property is on land that is 2 hectares or less and:

If you do not meet these conditions, you may still be entitled to a partial main residence exemption.

Follow these steps to calculate the proportion of your share of the property that is subject to CGT.

Step 1: Work out the number of days after the transfer that the property was not your main residence.

Step 2: If the property was transferred to you

Step 3: Add the amounts from steps 1 and 2. This is the non-main residence days.

Step 4: Work out the total number of days that either you or your former spouse owned the share of the property. This is the total ownership days.

Step 5: Divide the amount at step 3 (non-main residence days) by the amount at step 4 (total ownership days).

The result is the proportion of the transferred share that is subject to CGT.

If you had joint ownership of the property before the relationship breakdown, the share you owned did not roll over. You simply continued to own it.

To calculate the proportion of your original share that is subject to CGT:

George and Natalie jointly bought a holiday house.

Natalie is entitled to a partial main residence exemption because the property was used as a main residence for part of the combined ownership period.

Transferred share

The relationship breakdown rollover applies only to the half share transferred from George to Natalie.

The capital gain on this share is $200,000 × 50% = $100,000.

Using the steps above, Natalie calculates the assessable portion of her capital gain:

Natalie's assessable capital gain on the transferred share is:

$100,000 × 0.4 = $40,000

Natalie's original half share

The capital gain on Natalie's original half share is $200,000 × 50% = $100,000.

The property was Natalie’s main residence for 3 years out of the 5 years she owned her original half share. She works out the assessable portion of her capital gain as follows:

capital gain × (non-main residence days ÷ total ownership days) = assessable capital gain

$100,000 × (730 ÷ 1825) = $40,000

Capital gain to report

Natalie's total assessable capital gain for her original share and the transferred share is $40,000 + $40,000 = $80,000.

Natalie's ownership period is more than 12 months and she has no capital losses. Therefore, she can apply the 50% CGT discount to her assessable gain. The capital gain she reports in her tax return is:

$80,000 × 50% = $40,000.

The home first used to produce income rule may apply if a property was:

Under this rule, the property is treated as if it was acquired for its market value at the time it was first used to produce income.

This rule applies to you if the property (or a share of it):

Harry buys an apartment for $200,000 in 1999. He lives in it as his main residence.

A few years later, Harry and Anita marry. They move into Anita’s townhouse and Harry rents out his apartment. Its value is now $365,000.

In 2016, Harry and Anita's relationship breaks down. Harry transfers the apartment to Anita under a binding agreement and the CGT rollover applies.

Later, Anita sells the apartment. When working out the cost base, she uses the market value of the apartment when it was first used to produce income ($365,000), rather than its original purchase price ($200,000).

In certain circumstances, spouses can choose how the main residence exemption applies to their property or properties.

For example:

Usually, such choices do not need to be made until lodging a tax return for the year in which a property is disposed of.

However, for the purpose of negotiating a property settlement, former spouses would generally nominate their choices before the transfer of property.

The transferor spouse could provide a signed statement to the transferee spouse at the time of the property settlement as evidence of making a choice.

The transferee spouse could use this statement to support their calculation of CGT in the future.

Once a choice is made, it cannot be changed.

Denise buys a townhouse and lives in it before starting a relationship with Calvin. She then moves into a rented apartment with him and rents out her townhouse.

Two years later, the couple buy a house and live in it together. Denise continues to rent out her townhouse.

Years later their relationship breaks down. Under a binding financial agreement, they agree that:

Because the townhouse had been Denise’s main residence, she can choose to continue treating it as her main residence for up to 6 years after she moved out.

In negotiating their binding financial agreement, Denise provides Calvin with a signed statement that she chooses to treat the townhouse as her main residence for the 2 years between when she moved out and when they bought the house together.

Because the home first used to produce income rule applies, Calvin treats the townhouse as if he acquired it for its market value at the time Denise first rented it out. The period prior to this, when the townhouse was Denise's main residence, is ignored. This period is not included in their combined period of ownership.

When Calvin later sells the townhouse:

You can claim the main residence exemption when you sell or dispose of a property as a foreign resident, provided:

You cannot claim the full main residence exemption on a property, or a share of a property, that transferred to you under a relationship breakdown rollover from a company or trust.

The main residence exemption only applies for the period you lived in the property after the transfer.

To calculate the proportion of your capital gain or loss that is exempt from CGT: