To be eligible for the small business CGT concessions, your asset must pass the active asset test among other conditions.

An asset passes the active asset test if it has been an active asset of yours for at least:

The test period begins when you acquired the asset and ends at whichever occurs first:

You can apply for an extension of time if you dispose of the asset more than 12 months after the business ceases or is sold.

The period in which the asset is your active asset during the test period does not need to be continuous so long as the total length of time adds up to the minimum period or more.

Jodie ran a florist business from a shop she owned for 8 years. She ran the business for 5 years.

She then leased the shop to an unrelated party for 3 years before selling it.

The shop meets the active asset test because it was actively used in Jodie’s business for more than half the period of ownership, even though it was not used in the business just before it was sold.

A CGT asset is an active asset if you (or your affiliate or entity connected with you) use it, or hold it ready for use, in running a business (or if it is an intangible asset, it is inherently connected with the business).

An asset whose main use is to derive rent, interest, an annuity, royalties, foreign exchange gains usually cannot be an active asset. However, the asset can be active if either:

In 2018, Jasminka opens a restaurant called Dossier and registers the name in NSW.

The concept proves to be very popular and in 2019 Jasminka registers the name Dossier Australia wide. She also registers the Dossier logo as a trademark. During this time, she licenses the use of the name in a number of cities.

In 2023 Jasminka sells the Dossier trademark.

In this situation, the Dossier trademark would be an active asset. This is because the work Jasminka did in opening the original restaurant, together with her efforts in protecting, marketing and licensing 'Dossier', is considered substantial development so that its market value has been substantially increased.

For an asset to be held ready for use in running a business, it needs to be in a state of preparedness for use in the business and functionally operative. As such, premises still under construction, or land on which you intend to construct business premises, cannot be said to be 'held ready for use' and would, therefore, not be active assets at that time.

The following assets cannot be active assets:

When an asset's main use is to derive rent (unless such use is temporary) it is not considered an active asset. This is the case even if the asset is used in running a business.

Whether an asset's main use is to derive rent depends on the circumstances of each case. A key factor in determining whether an occupant of premises is a lessee paying rent is whether they have a right to exclusive possession. Other relevant factors to consider in regard to exclusive possession include the degree of control retained by the owner and the extent of any services provided by the owner such as room cleaning, provision of meals, supply of linen and shared amenities.

For example, if premises are leased to a tenant under a lease agreement granting exclusive possession, the payments involved are likely to be rent. On the other hand, if the arrangement allows the person only to enter and use the premises for certain purposes and does not amount to a lease granting exclusive possession, the payments involved are not likely to be rent.

An asset that is leased to a connected entity or affiliate for use in its business may still be an active asset. It is the use of the asset in that entity’s business that will determine the active asset status of the asset.

All uses of an asset are considered in determining what the main use of the asset is and, therefore, whether it is an active asset. However, personal use of the asset by you or an individual who is your affiliate is not considered in determining the main use of the asset.

The use of the asset to derive rent from a third party (an entity not an affiliate or connected with the asset owner) will be considered use to derive rent, even if that entity uses the asset in their business. This is because the use of the asset by the asset owner is to derive rent.

However, use of the asset by a relevant entity (an entity that is an affiliate or connected with the asset owner) is treated as the use by the asset owner, even if the asset owner receives rent from the relevant entity for the use of that asset. This means, if the relevant entity uses the asset:

Rachael runs a business renting properties for short periods of time on an online platform. The terms and conditions state that tenants have exclusive possession of the properties. This means the tenant has permission to exclusively use and occupy the property. Rachael offers no additional services to the tenants during their stay and tenants are expected to provide their own linen and clean the property before vacating.

The properties are not active assets because their main use is to derive rent. Therefore, Rachael would not meet the basic eligibility conditions for the small business CGT concessions.

Tanya owns a motel (land and buildings), which she uses to run a business.

As part of the business, the motel provides room cleaning, breakfast, laundry and other services.

Guests staying in the motel do not receive exclusive possession. But simply have a right to occupy a room under certain conditions.

The usual length of stay by guests is between one and seven nights.

The motel is an active asset because its main use is not to derive rent.

Michael owns land, which holds 3 industrial sheds.

He uses one shed (45% of the land by area) to conduct a motorcycle repair business.

He leases the other 2 sheds (55% of the land by area) to unrelated third parties.

The income derived from the motorcycle repair business is 80% of the total income (business plus rentals). This is derived from the use of the land and buildings.

In determining main use of the land, a range of factors must be considered.

In this case, a substantial (although not a majority) proportion (45%) of the land is used for business purposes.

The business proportion of the land derives the vast majority (80%) of the total income.

Given all the circumstances, the ATO considers the main use of the land is not to derive rent. Therefore, the land is an active asset.

When the original parcel of land is subdivided into new blocks, these are considered new, separate assets.

If land is subdivided into both vacant land and land used to run a business, the new subdivided blocks of vacant land are not active assets.

For CGT purposes, when an asset is split into 2 or more assets you are the owner of both the original asset and the new assets, the split is not a CGT event.

Tom acquired 10 hectares of land as a single parcel 20 years ago.

He uses 3 distinct areas of land for different purposes:

Tom decides to subdivide all the land into residential blocks. Tom is not running a land development business so the subdivided blocks will not be trading stock. After the subdivision is complete, Tom will sell each block, including those created out of the vacant part of the land.

The new subdivided blocks are considered to be acquired by Tom when the original parcel was acquired. The disposal of a subdivided block is treated as the disposal of an asset in its own right, and not as a disposal of part of an asset (the original land parcel).

The new subdivided blocks created out of the:

Shares in companies and interests in trusts can be active assets if they meet the 80% test.

The test is met if the market value of the company or trust's active assets and financial instruments and cash (those that are inherently connected with the business) make up at least 80% of the market value of all of the company or trust’s assets.

Inherent connection requires more than just some form of connection between the cash or financial instrument and the business. Examples of things inherently connected to a business include:

Archimedes Pty Ltd is a manufacturing business. It lends $300,000 to a related company, Galileo Pty Ltd, to acquire assets for business use between both companies.

The loan is made between members of a corporate group as part of the overall financing of the group.

However, the loan is not a permanent or characteristic attribute of the business (which is manufacturing, not the acquisition of assets). It is a financial instrument but not inherently connected with the business of manufacturing.

Therefore, the $300,000 loan is included in the total market value of all the assets, but not included as an active asset.

The market value of Archimedes Pty Ltd.'s active assets is $700,000 (without the loan). The market value of all its assets (including the loan) is $1 million.

The 80% test calculation is:

$700,000 ÷ $1 million = 70%

This means that the 80% test is not met.

The 80% test will be considered to be met where the total market value of the active assets falls below 80% of the total market value of the company or trust and:

Depreciating assets, such as plant, are CGT assets. They can be active assets and included in the 80% test.

Joshua owns a fruit shop. He sells an active asset that meets the basic CGT eligibility conditions. He makes a capital gain on the asset.

Later, he acquires shares in Fruit and Veg Co as replacement assets. Fruit and Veg Co runs his family business.

The shares Joshua acquired meet the 80% test. As a result, they are active assets.

Several years later, Fruit and Veg Co borrows money to pay a dividend and fails the 80% test.

2 weeks later they pay the dividend and the shares pass the 80% test again.

For the 2 interim weeks, the shares Joshua acquired in Fruit and Veg Co are treated as active assets.

There are modified rules to determine if the active asset test is met for CGT assets acquired or transferred under the rollover provisions relating to assets compulsorily acquired, lost or destroyed, or to marriage and relationship breakdown.

If you acquired a replacement asset to meet the rollover requirements for the involuntary disposal of a CGT asset, the replacement asset is treated as if:

If a CGT asset is transferred to you from a relationship breakdown and you roll over the capital gain that arises from that transfer, you can choose whether to:

If you choose to include the ownership and active asset periods of your former spouse, the asset is treated as if it had been:

The active asset test normally requires you to own the CGT asset before the CGT event occurs.

However, when CGT event D1 occurs (creating rights in another entity), the relevant CGT asset (the rights) is created in the other entity without you owning it. Therefore, it would not be possible to meet the active asset test. In this case, the active asset test is modified and requires the right you create (that triggers the CGT event) to be inherently connected with another CGT asset that meets the active asset test.

You may be eligible for the CGT concessions to the same extent that the deceased would have been just prior to their death if you receive the asset as a:

You will be eligible for the concessions where the CGT event relating to the asset occurs within 2 years of the individual’s death.

Otherwise, the active asset test applies to you in the normal way for any capital gain made on a sale of the assets after the 2-year time limit. This means that if you do not continue to run the deceased's business, or use the asset in another business, after the 2 years, the active asset test may not be met, and the small business concessions may not be available.

The ATO can extend the 2-year time period in certain situations.

Extra eligibility conditions for the small business CGT concessions if the asset is a share or interest in a trust.

If the capital gains tax (CGT) asset is a share in a company or interest in a trust, you must meet the following extra conditions, in addition to the basic eligibility conditions, to be eligible for the small business CGT concessions:

You are a CGT concession stakeholder of a company or trust if you are either:

You can hold the small business participation percentage directly or indirectly through one or more interposed entities.

You work out the small business participation percentage in the same way as the significant individual test.

You are a significant individual in a company or trust if you have a small business participation percentage in the company or trust of at least 20%. This 20% can be made up of direct and indirect percentages.

A company or trust meets the significant individual test if it had at least one significant individual just before the CGT event.

An entity’s small business participation percentage in another entity's test time is the sum of the entity's:

An entity’s direct small business participation percentage in a company is the smallest percentage out of:

The smallest percentage could be 0%. This could be if shares do not have voting rights or if the shares do not carry a right to capital distributions or dividends.

Take all classes of shares (other than redeemable shares) into account when determining an entity’s participation percentage.

Ignore the voting power calculation for jointly owned shares because neither owner individually controls the voting power.

Brave Company has 2 different classes of shares, A and B, which have equal voting and distribution rights.

The directors of the company can decide to make a distribution of income or capital to either class of shares to the exclusion of the other class of shares.

Isaac holds 22% of each class of shares. This means he:

Isaac is a significant individual because his smallest small business participation percentage in the company is 22% (and it must be at least 20%).

An entity’s direct small business participation percentage in a trust, where entities have entitlements to all the income and capital of the trust, is the lower percentage of either the:

An entity’s direct small business participation percentage in a trust (where entities do not have entitlements to all the income and capital of the trust, and the trust makes a distribution of income or capital) is the lower percentage of either distributions of:

An entity can use another method to work out their small business participation percentage in a discretionary trust if, in the CGT event year, both:

The entity's direct small business participation percentage at the relevant time is the percentage of the distributions the entity was beneficially entitled to in the last income year before the CGT event in which the trustee made a distribution.

An entity's small business participation percentage is zero if either the:

After a bad trading year, XYZ Trust:

In the year prior to the CGT event year, the trustee makes a distribution of income to the following beneficiaries as:

Evangeline, Dennis and Katrin all have a small business participation percentage in XYZ Trust of at least 20%. This makes them significant individuals and CGT stakeholders in XYZ Trust.

An entity’s indirect small business participation percentage in a company or trust is the entity’s direct participation percentage in an interposed entity multiplied by the interposed entity’s total participation percentage (both direct and indirect) in the company or trust.

An indirect interest can be held through one or more interposed entities.

If a trust has a tax loss or no net income for the income year, a beneficiary of a discretionary trust may calculate their indirect small business participation percentage to be more than zero.

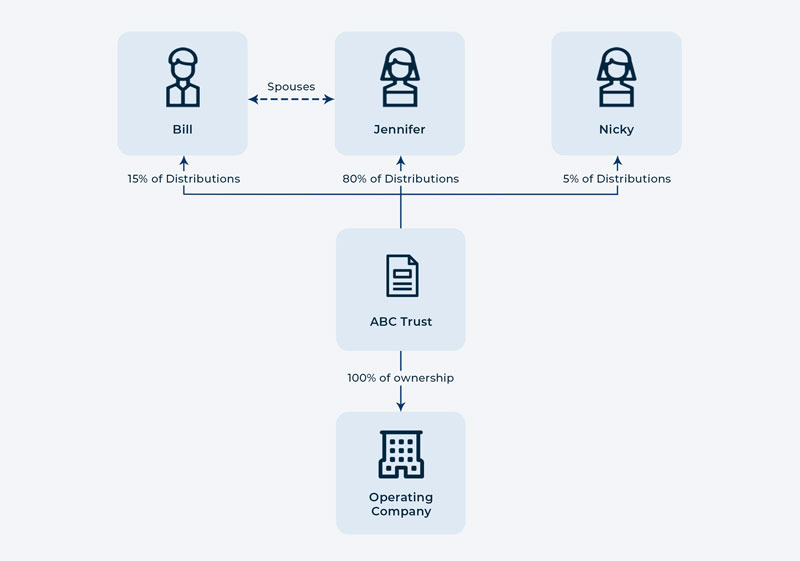

ABC Trust owns 100% of the shares in Operating Co. Therefore, ABC Trust has a 100% direct interest (and no indirect interest) in Operating Co.

Jennifer, Bill and Nicky are the beneficiaries of ABC Trust.

Jennifer

Jennifer receives 80% of the distributions from ABC Trust. Therefore, she has a direct participation percentage of 80% in ABC Trust.

Jennifer’s participation percentage in Operating Co is calculated by multiplying Jennifer’s direct participation percentage in ABC Trust and ABC Trust’s total participation percentage in Operating Co:

Jennifer has an 80% participation percentage in Operating Co, so she is a significant individual of Operating Co.

Bill

Jennifer's spouse, Bill, receives 15% of the distributions from ABC Trust. Therefore, he has a direct participation percentage of 15% in ABC Trust.

Bill’s participation percentage in Operating Co is calculated by multiplying his direct participation percentage in ABC Trust and ABC Trust’s total participation percentage in Operating Co:

Bill has a 15% participation percentage in Operating Co, so he is not a significant individual of Operating Co.

However, as a spouse of a significant individual with a participation percentage greater than zero in the entity, Bill will be a CGT concession stakeholder.

Nicky

Nicky receives 5% of the distributions from ABC Trust. Therefore, she has a direct participation percentage of 5% in ABC Trust.

Nicky’s participation percentage in Operating Co is calculated by multiplying her direct participation percentage in ABC Trust and ABC Trust’s total participation percentage in Operating Co:

Nicky has a 5% participation percentage in Operating Co, so she is not a significant individual of Operating Co. Nicky is not a CGT concession stakeholder.

The 90% test only applies if there is an interposed entity between the CGT concession stakeholders and the company or trust in which the shares or interests are held. The interposed entity is the entity accessing the concessions.

The test is met if CGT concession stakeholders in the company or trust in which the shares or interest are held have a total small business percentage in the entity claiming the concession of at least 90%.

Like the significant individual test, the participation percentage can be held directly or indirectly through multiple interposed entities.

Based on the above 'Example: calculating the participation percentage of a trust to determine significant individuals':

At least 90% of the participation percentages in ABC Trust are held by CGT concession stakeholders of Operating Co (Jennifer and Bill). As a result, ABC Trust meets the ownership requirement if it sells its shares in Operating Co, and can access the concessions on those shares, provided the other conditions are met. ABC Trust is not a CGT concession stakeholder in Operating Co because it is not an individual.

The company or trust must be a small business entity or meet the maximum net asset value test using the modified connected entity rule. When applying each of these tests, the company or trust must include the annual turnovers and assets of its affiliates and entities controlled by it.

Under the modified connected entity rule, the company or trust controls another entity if it has a control percentage of at least 20% in the other entity.

Any Commissioner's determination that the entity does not control another entity (discretion about control between 40% and 50%) is disregarded for the modified connected entity rule.

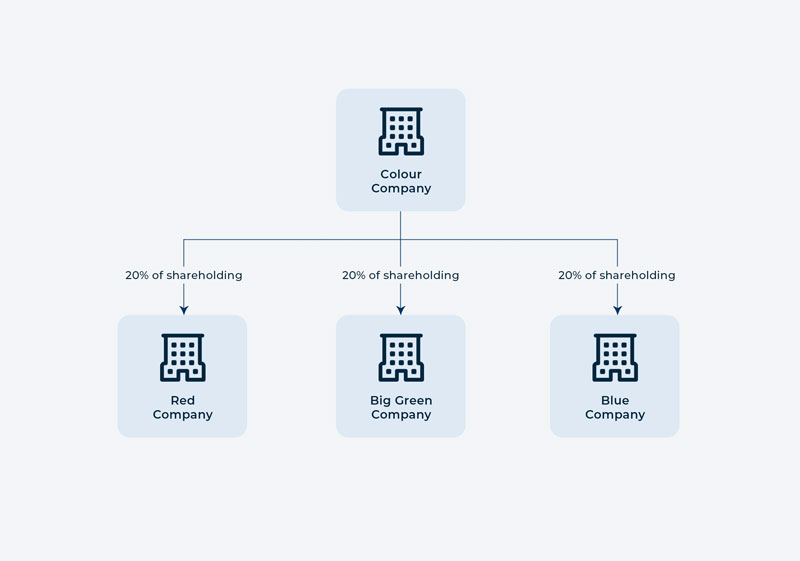

Colour Co is a small business entity with an aggregated turnover of less than $2 million.

When applying the general connected entity rule, Red Co, Big Green Co and Blue Co would not be connected with Colour Co because Colour Co holds less than 40% of shares in each of them.

However, to determine if Colour Co is a small business entity or meets the maximum net asset value test to access the small business CGT concessions, the ATO needs to apply the modified connected entity rule. This is because the CGT asset is a share in a company.

Because Colour Co owns 20% of the shares in Red Co, Big Green Co and Blue Co, Colour Co controls them. Therefore, Colour Co must include the annual turnovers in its aggregated turnover and the net asset values in the maximum net asset value test.

Big Green Co has an annual turnover of $5 million (from dealings unrelated to Colour Co) and the net value of its assets is $20 million. This means Colour Co would not:

meet the maximum net asset value test as the total net value of the assets owned by Colour Co and entities controlled by it (Red Co, Big Green Co, Blue Co) exceeds $6 million.

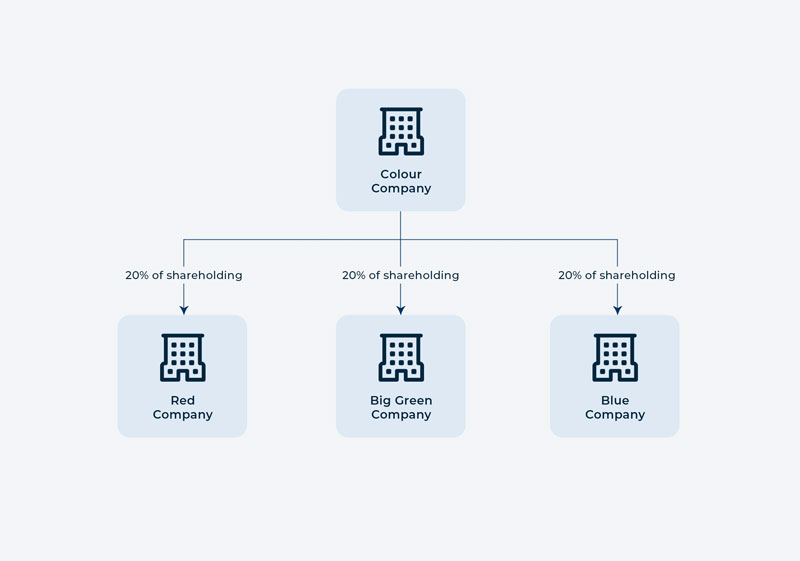

Colour Co is a small business entity with an aggregated turnover of less than $2 million.

When applying the general connected entity rule, Red Co, Big Green Co and Blue Co would not be connected with Colour Co because Colour Co holds less than 40% of shares in each of them.

However, to determine if Colour Co is a small business entity or meets the maximum net asset value test to access the small business CGT concessions, the ATO needs to apply the modified connected entity rule. This is because the CGT asset is a share in a company.

Because Colour Co owns 20% of the shares in Red Co, Big Green Co and Blue Co, Colour Co controls them. Therefore, Colour Co must include the annual turnovers in its aggregated turnover and the net asset values in the maximum net asset value test.

Big Green Co has an annual turnover of $5 million (from dealings unrelated to Colour Co) and the net value of its assets is $20 million. This means Colour Co would not:

meet the maximum net asset value test as the total net value of the assets owned by Colour Co and entities controlled by it (Red Co, Big Green Co, Blue Co) exceeds $6 million.

In determining whether your share in a company or interest in a trust meets the modified active asset test, your share or interest must have been an active asset with some modifications to the 80% test.

Whilst the modified 80% test must be met for at least half of the asset ownership period, it does not need to be applied on a day-to-day basis.

When applying the modified 80% test, a share in a company or an interest in a trust will continue to be an active asset at a later time if it:

A temporary breach of this requirement will not result in the test being failed.

Work out the total market value of both:

Exclude the market value of shares or interests held, directly or indirectly, by the company or trust.

Work out the total market value of both:

Assets of a later entity are only active assets if both:

At least 80% of the step 1 amount must be made up of:

Any cash or financial instruments acquired or held by the company or trust only for the purpose of meeting the 80% requirement are disregarded.

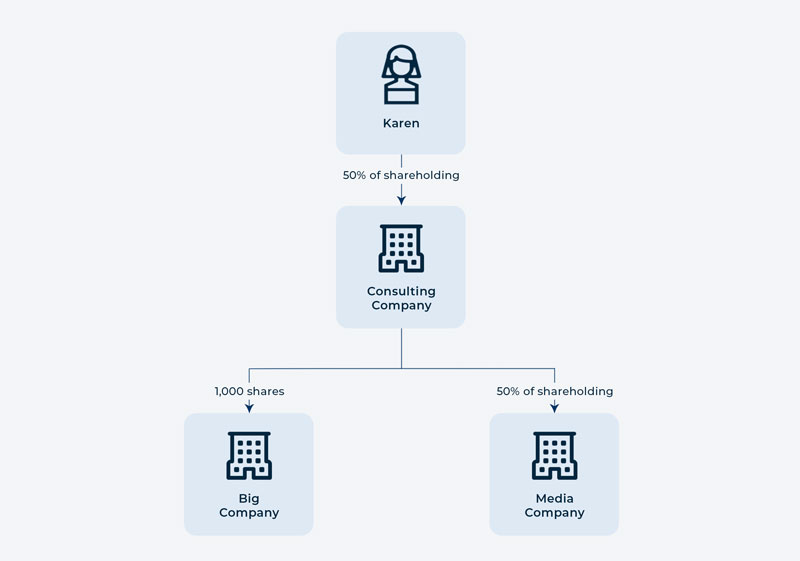

Karen is a sole trader and is a small business entity with an aggregated turnover of less than $2 million (applying the general connected entity rule) for the 2018–19 income year.

Karen owns 50% of the shares in Consulting Co, which is a small business entity with an aggregated turnover of less than $2 million (applying the modified connected entity rule) for the 2018–19 income year.

The total market value of Consulting Co's assets (excluding the value of shares in Big Co and Media Co) is $1 million, of which $980,000 is the value of its active assets.

Consulting Co also owns 1,000 shares of the 10 million shares in Big Co. Consulting Co's small business participation percentage in Big Co is 0.01%. The total market value of Big Co's assets is $100 million.

Consulting Co also owns 50% of Media Co, which is a small business entity with an aggregated turnover of less than $2 million. The total market value of Media Co's assets is $1.2 million, of which $1 million is the value of its active assets.

There are no significant amount of cash and financial instruments inherently connected to the business of Consulting Co and Media Co.

There has been no significant change in the activities or holdings of Consulting Co, Big Co and Media Co over the period Karen has owned the shares.

On 20 April 2019, Karen sells her shares in Consulting Co.

The shares need to meet the modified active asset test for Karen to access the small business CGT concessions.

Step 1: Work out the total market value of the entity

The total market value of the assets in Consulting Co and other entities that Consulting Co has a small business participation percentage in (Big Co and Media Co) is $1.61 million. This is the sum of:

Step 2: Work out the total market value of active assets

The market value of Consulting Co's active assets is $980,000.

An asset of Media Co can only be an active asset for Consulting Co if Karen is a CGT concession stakeholder of Media Co.

Karen's small business participation percentage is 25% in Media Co, calculated as 50% (Karen's small business participation percentage in Consulting Co) × 50% (Consulting Co's participation percentage in Media Co).

As Karen's small business participation percentage in Media Co is at least 20%, the market value of Media Co's active assets ($500,000) is included. This is calculated as $1 million (Media Co's active assets) × 50% (Consulting Co's participation percentage in Media Co).

Big Co's assets are not included as Karen is not a CGT concession stakeholder of Big Co.

$980,000 (market value of Consulting Co's active assets) + $500,000 (market value of Media Co's active assets) = $1.48 million.

Step 3: Calculate the minimum 80% requirement

Karen's shares meet the modified active asset test because:

there have been no significant changes to the activities or holdings of the relevant entities during the ownership period.

If you made a capital gain relating to shares in a company or an interest in a trust before 8 February 2018, there are fewer conditions you need to meet to be eligible.

You must meet the basic CGT concessions eligibility conditions and just before the CGT event you must either: