Work out if you can pay a super benefit to a member and the types of benefits that exist.

Generally before you pay a member's super benefits, you need to ensure the:

Benefit payments to members who have not met a condition of release are not treated as super benefits. Instead, they will be taxed as ordinary income at the member's marginal tax rate. This is also known as illegal early release of super.

If a benefit is unlawfully released, the ATO may apply significant penalties to:

In addition the ATO may disqualify the trustees involved. This is published in the Government Notices Gazette.

Operating standards, investment restrictions and other rules and regulations that apply to SMSFs in the accumulation or growth phase, continue to apply when members begin receiving a pension from the SMSF.

Where your member has met a condition of release, you can either pay the benefit as a lump sum or super income stream.

If a member has died, you will generally pay a death benefit to their dependant or other beneficiary of the deceased. There are additional rules to consider.

You should also consider if the income stream is an innovative retirement income stream which covers a range of lifetime products.

Most of the super held in your fund will be in the form of preserved benefits. These must be preserved in the fund until the time the law and your fund’s trust deed allows them to be paid.

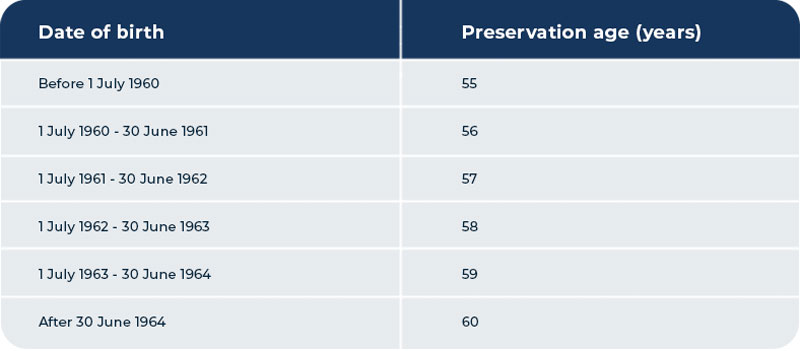

Access to super benefits is generally restricted to members who have reached preservation age. A person's preservation age ranges from 55 to 60, depending on their date of birth.

All contributions made by or on behalf of a member, and all earnings since 30 June 1999, are preserved benefits.

Preserved benefits may be cashed voluntarily only if a condition of release is met and subject to any cashing restrictions imposed as part of the condition of release.

Cashing restrictions tell you what form the benefits need to be taken in.

These benefits generally stem from employment-related contributions (other than employer contributions) made before 1 July 1999.

Restricted non-preserved benefits can't be cashed until the member meets a condition of release specific to these benefits such as a nil cashing restriction or where the employment they relate to has been terminated.

These benefits don't require a condition of release to be met and may be paid on demand by the member. They include, for example, benefits for which a member has previously satisfied a condition of release and decided to keep the money in the super fund.

Certain employer termination payments (ETPs) received by the fund before 1 July 2004 may also be included in this category of benefits.

A self-managed super fund (SMSF) can pay benefits in the form of a lump sum, an income stream (pension) or a combination of both, provided the payment is allowed under super law and the fund's trust deed.

When you pay a benefit, you need to decide what type of payment it is (lump sum or pension) and the account it will be paid from (if applicable). You need to document this at the time the payment is requested. You can record it in trustee minutes.

You have to withhold tax from benefit payments to members who are:

What are the conditions of release a member must satisfy to receive self-managed super fund (SMSF) benefits.

To pay benefits, a member must satisfy one of the conditions of release. As a trustee, you must:

If the member has met a condition of release, make sure you keep records and proof that show they have met all the requirements. Your auditor will need to make sure you haven't illegally released any benefits.

It's possible that a benefit may be payable under the super laws, but not under the rules of your SMSF.

Some conditions of release restrict the:

These are known as 'cashing restrictions'.

The most common conditions of release are that the member:

In certain circumstances, where a member meets the eligibility requirements, they may have at least part of their super benefits released before they reach preservation age. These circumstances include if they:

Benefits could previously be released as part of the COVID-19 early release of super program. This program closed on 31 December 2020.

Generally, rollovers to other super funds don’t require the member to satisfy a condition of release, subject to the governing rules of your SMSF.

Unrestricted non-preserved benefits don't require a condition of release to be met and may be paid at any time. They include, for example, benefits for which a member has previously satisfied a condition of release and decided to keep the money in the super fund. Certain employer termination payments (ETPs) received by the fund before 1 July 2004 may also be included in this category of benefits.

Releasing benefits to members who have not met a condition of release is illegal. If you do this, you are liable for administrative penalties in your capacity as a trustee.

The withdrawn amount will be included in the member's assessable income, even if they pay it back later. This means they may pay:

Both the trustee who released the super and the member who accessed it may also be disqualified as trustees of the SMSF. If disqualified:

This means your disqualification will be on public record. This can have an adverse impact on you professionally, personally or financially.

If you illegally access your super or have been involved in a scheme promoting illegal early access to your super, contact the ATO immediately. When the ATO determine penalties, the ATO will take your circumstances and voluntary disclosure into account.

If the member is:

For retirement, there are no restrictions on the form in which the benefits can be taken.

An SMSF can pay a transition to retirement income stream to a member who has reached preservation age and is still working, provided the trust deed of the fund allows this type of income stream to be paid.

A transition to retirement income stream must be an account-based pension. The amount paid to the recipient each year must meet a specified minimum and must not exceed 10% of the account balance on the commencement of a TRIS for the year it starts or on 1 July for each subsequent year. For frequently asked questions, see SMSFs: Minimum pension payment requirements.

The transition to retirement measure can be complex. It's best to get advice from a financial adviser, accountant or tax professional.

If a member who is 60 years old or over gives up one employment arrangement but continues in another employment relationship, they may:

A member who has reached 65 years old may cash their benefits at any time. There are no cashing restrictions, which mean the benefits can be paid as an income stream or a lump sum.

A fund member is not compelled to draw down their super once they reach a particular age. They can keep their benefits in the fund indefinitely. The only time it is compulsory for an SMSF to pay out a member’s benefit is when a member dies.

Only in very limited circumstances can super be accessed early. These are mostly related to specific expenses.

Subject to the governing rules of your fund, where a member (who has not met another condition of release) has ceased employment with an employer who had contributed to the member's fund, on termination:

A member's benefits may be released if they cease gainful employment and you're satisfied that the member is unlikely, because of ill health, to engage in gainful employment that they are reasonably qualified for by education, training or experience. There are no cashing restrictions on payment of benefits.

A member's benefits may be paid if you're satisfied that the member has temporarily ceased work due to physical or mental ill health that does not constitute permanent incapacity. In general, temporary incapacity benefits may be paid only from the insured benefits or voluntary employer funded benefits.

It's not necessary for the member's employment to fully cease but, generally, a member would not be eligible for temporary incapacity benefits if they were receiving sick leave benefits. The benefit must be paid as an income stream for the period of the incapacity and can't be commuted to a lump sum.

To release benefits under severe financial hardship you need to be satisfied that the member:

The payment must be a single gross lump sum of no more than $10,000 and no less than $1,000 (or a lesser amount if the member's benefits are less than $1,000). Only one payment is permitted in any 12-month period.

Alternatively, if the member has reached their preservation age, you need to be satisfied that the member:

If you release benefits under these circumstances, there are no cashing restrictions.

For benefits to be released on compassionate grounds, a member must meet certain criteria and receive ATO approval prior to the trustee releasing any funds (see Early access to your super). Circumstances the member must meet to qualify are where:

The amount of super that you can pay on compassionate grounds is limited to what is reasonably needed. It is paid as a lump sum.

If a member has a terminal medical condition and 2 medical professionals certify that the condition is likely to result in the member’s death in the next 24 months, the balance of their super account may be paid as a tax-free lump sum benefit. There are no cashing restrictions, see Access to super for members with a terminal medical condition.

The first home super saver (FHSS) scheme allows your fund members to save for their first home inside their super. Your members can do this by making voluntary concessional and non-concessional contributions to their super. When your members are ready to receive their FHSS amounts, they can request a release from the ATO to withdraw personal contributions they have made into super since 1 July 2017, along with associated earnings.

If your member's request to release a FHSS amount is successful, the ATO will issue you with a release authority letter showing the amount you are required to send to us. The ATO will also send you a release authority statement form, which you will need to complete (which must be completed in all cases, including partial releases or where you are unable to release any amounts). You are required to comply with this release authority within 10 business days of the date on the letter.

Even if your member has not made voluntary contributions to your fund, the FHSS amount can still be released from their account subject to the applicable cashing order of benefit rules. Once you have sent any FHSS release amounts to us, the ATO will withhold the appropriate amount of tax, and in some cases offset the remaining amount against any outstanding Commonwealth debts. The ATO will then pay the balance of the FHSS release amount to your member.

The COVID-19 early release of super program closed on 31 December 2020; applications can no longer be accepted.

Eligible individuals were able to access up to $10,000 of their super between 19 April 2020 and 30 June 2020 and then a further $10,000 between 1 July and 31 December 2020 to help deal with the adverse economic effects of COVID-19.

If you withdrew money from your super fund through the COVID-19 early release of super program, you can re-contribute COVID-19 early release super amounts.

When a self-managed super fund (SMSF) member dies, the SMSF generally pays a death benefit to a dependant or other beneficiary of the deceased. This should be done as soon as possible after the member's death.

If the recipient is a dependant of the deceased, the death benefit can be paid as a lump sum or income stream. The income stream can be new or a continuation of an existing income stream.

If the recipient is not a dependant of the deceased, the death benefit must be paid as a lump sum.

If a member requested an amount to be paid from their fund before they died, but died before they received it, it may be a member benefit in some limited cases. This is determined by the facts and circumstances surrounding the payment.

A trustee of a regulated super fund can only pay super benefits according to the governing rules of the fund, including the:

The governing rules set out when benefits can be paid and who they can be paid to, including after a member’s death. The governing rules of the fund must be read carefully to determine a member’s benefit entitlements in the event of death.

At the time of payment, the trustee must assess whether it is a member or death benefit based on the facts known at the time, including:

For advice on specific circumstances, the executor or legal representative of a member's estate can apply for a private ruling.

Jack and Jill are spouses, and members and trustees of the Hill SMSF. Jack has a terminal medical condition. He makes a request to his SMSF for release of his super.

Before the benefit payment is made, Jack passes away. It is then paid to an account belonging to his legal personal representative, forming part of Jack’s deceased estate.

At the time of payment Jill, as the surviving trustee, considered the above factors and determined that the payment is a death benefit. Notably:

Satine is a member of an Australian Prudential Regulation Authority (APRA) regulated super fund. She has a terminal medical condition. Satine makes a request to her fund for release of her super benefits.

Before the benefit payment is made, Satine passes away. The trustee does not become aware of this until after the benefit is paid to the account in Satine’s request.

The terms of the trust deed allow for release where a member meets a condition of release under Schedule 1 of the Superannuation Industry (Supervision) Regulations 1994 (SISR) with a nil cashing restriction.

At the time of payment, the trustee considers the above factors and determines that the payment is a member benefit. Notably, the trustee:

A person is a dependant of a deceased member if, at the time of death, that person was:

For income tax purposes, a person is death benefits dependant of a deceased member if, at the time of death, that person was:

Also included in the definition of a death benefit dependant is someone receiving a super lump sum because the deceased died in the line of duty as a:

The member may have made a death benefit nomination asking the SMSF trustees to pay their death benefit to their nominated beneficiaries.

The nomination may be binding or non-binding. While having regard to the member's nomination, the SMSF trustees must ensure the nominated beneficiaries are entitled to receive death benefits under the trust deed and super law.

If the deceased member did not nominate a beneficiary, the trustee may pay it to the deceased's estate for the executor to distribute it according to the instructions in their will.

If the death benefit is paid as a lump sum to a dependant of the deceased, it's tax free. It's not assessable income or exempt income. The SMSF doesn't withhold tax from the payment and the recipient doesn't include it in their income tax return.

If the death benefit is paid as an income stream or is paid to a non-dependent or the trustee of a deceased estate, there may be tax to pay. Your SMSF will need to determine the taxed and untaxed elements of the benefit, calculate the applicable tax and, if appropriate, withhold tax from payments.

A tax saving amount is an additional lump sum payment that increases the deceased member's lump sum death benefit to negate the effect of tax while the member's benefit was accumulating in the fund. It can be made to a:

The SMSF can claim an income tax deduction for the payment.

Note: From 1 July 2017, funds may only include a tax saving amount as part of a death benefit if the member has died on or before 30 June 2017. The fund must make this payment by 30 June 2019. From 1 July 2019, no tax saving amount will be available for funds members, regardless of when the member has died.