As an SMSF trustee, you can accept contributions and rollovers for your members from various sources but there are some restrictions, mostly depending on the member’s age and the contribution caps.

You need to properly document contributions and rollovers, including the amount, type and breakdown of components, and allocate them to the members’ accounts within 28 days of the end of the month in which you received them.

From 1 October 2021 to rollover any super to or from your SMSF, you will need to use SuperStream.

There are minimum standards for accepting contributions into your SMSF.

There are minimum standards for accepting contributions into your self-managed super fund (SMSF), and the trust deed of your fund may have more rules.

Whether a contribution is allowable depends on:

Generally, you can't accept an asset as a contribution from related parties of your fund, but there are some exceptions.

If your SMSF will receive contributions from employers (other than related-party employers), you'll need an electronic service address to receive the associated SuperStream data.

When a member joins your fund, you need to ask for their TFN and provide it to us. You can do this when you register the fund or when a new member joins.

A member is not required by law to provide their TFN, however if they don't:

If the member hasn’t provided their TFN and you’ve accepted member contributions for them, you’ll need to return the contribution within 30 days (of becoming aware of the contribution). However, if they provide their TFN within 30 days of receiving the contribution, you don’t have to return the amount.

If you receive employer contributions on behalf of a member and you pay additional income tax because you did not have your member’s TFN, you may be able to claim a tax offset in a later financial year if the member later gives you their TFN.

Mandated employer contributions are contributions made by an employer under a law or industrial agreement for the benefit of a fund member. They include super guarantee contributions.

You can accept mandated employer contributions for members at any time, regardless of their age or the number of hours they’re working.

Non-mandated contributions include:

Non-mandated member contributions can only be accepted if you have their tax file number (TFN). If you receive a member contribution and you don’t have the member’s TFN, you need to return the contribution within 30 days unless the member’s gives you their TFN within that period.

You can accept non-mandated contributions in the following circumstances.

From 1 July 2022, you can accept all types of non-mandated contributions, except downsizer contributions (these can only be made if the member has reached eligible age).

For a member turning 75, contributions must be received no later than 28 days after the end of the month they turn 75.

Between 1 July 2020 and 30 June 2022, you could accept all types of non-mandated contributions for members under 67. If they were between 67 and 75, you could only accept non-mandated contributions if they were gainfully employed on at least a part-time basis.

Before 1 July 2020, you could accept all types of non-mandated contributions for members under 65. If they were between 65 to 75, you could only accept non-mandated contributions if they were gainfully employed on at least a part-time basis.

You can accept downsizer contributions (there is no maximum age limit) if you have their TFN, but you generally can't accept other non-mandated contributions.

Super co-contributions and employer contributions that relate to a valid contribution period for the member can be accepted at any time.

Note: 'Gainfully employed on at least a part-time basis' means the member is gainfully employed for at least 40 hours in a period of 30 consecutive days in each financial year in which the contributions are made. Unpaid work does not meet the definition of 'gainfully employed'.

'In specie' contributions are contributions to your fund in the form of a non-monetary asset.

Generally, you must not intentionally acquire assets (including in specie contributions) from related parties of your fund. However, there are some exceptions to this rule, including:

Work out your concessional and non-concessional contribution caps by financial year.

A member whose total contributions exceed the contribution caps in a year may be liable for additional tax on the excess contributions. Contribution caps are indexed annually.

There are minimum standards for accepting contributions into your SMSF and the trust deed of your fund may have more rules.

Concessional contributions are contributions made into your SMSF that are included in the SMSF's assessable income. These contributions are taxed in your SMSF at a ‘concessional’ rate of 15%, which is often referred to as ‘contributions tax’.

The most common types of concessional contributions are employer contributions, such as super guarantee and salary sacrifice contributions. Concessional contributions also include personal contributions made by the member for which the member claims an income tax deduction.

Concessional contributions are subject to a yearly cap:

From 1 July 2018, members can make 'carry-forward' concessional super contributions if they have a total superannuation balance of less than $500,000. Members can access their unused concessional contributions caps on a rolling basis for 5 years. Amounts carried forward that have not been used after 5 years will expire.

The first year in which you can access unused concessional contributions is the 2019–20 financial year.

Generally, non-concessional contributions are contributions made into your SMSF that are not included in the SMSF's assessable income.

Non-concessional contributions include:

Non-concessional contributions do not include:

If a member’s non-concessional contributions exceed the cap, a tax of 47% is levied on the excess contributions. Individual members are personally liable for this tax and must have their super fund release an amount of money equal to the tax.

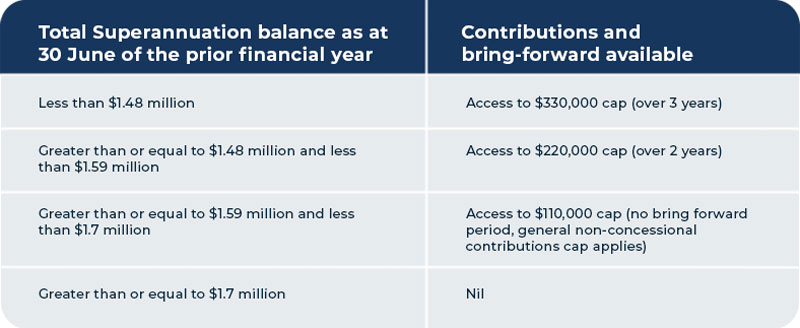

From 1 July 2022, the non-concessional contributions cap is $110,000. Members under 75 years of age may be able to make non-concessional contributions of up to 3 times the annual non-concessional contributions cap in a single year.

If eligible, when you make contributions greater than the annual cap, you automatically gain access to future year caps. This is known as the ‘bring-forward’ option.

From the 2022–23 financial year members who are under 75 may be able to access a bring-forward arrangement as outlined in the table below.

From 1 July 2021, the non-concessional contributions cap increased from $100,000 to $110,000.

For the 2017–18, 2018–19, 2019–20 and 2020–21 financial years, the non-concessional contributions cap is $100,000.

For the 2014–15, 2015–16 and 2016–17 financial years, non-concessional contributions are subject to a yearly cap of $180,000 for members 65 or over but under 75 or $540,000 over a 3-year period for members under 65.

Transitional arrangements apply to individuals who brought forward their non-concessional contributions cap in the 2015–16 or 2016–17 financial years.

A rollover is when you, as a member, transfer some or all of your existing super between super funds, including SMSFs.

It is a legal requirement for rollovers to be processed electronically, using 2 components:

There are some exceptions.

Before making a rollover, there are several steps you need to complete to ensure it is successful.

Trustees must complete the rollover no later than 3 business days after receiving all the required information. Systems must be in place to action the requests. If your fund doesn't meet this requirement they could receive a compliance breach.

If a member is eligible, they can claim an income tax deduction for super contributions they make for their own benefit. A member who intends to claim a deduction must notify you of this intent.

The member must give you the notice by the earlier of:

The notice is invalid if:

In these circumstances, the member will not be able to claim a deduction for the personal contribution made.

You must acknowledge your member's valid notice. Your acknowledgment should include:

This ensures that your members are able to claim the deductions they're entitled to and that super co-contributions and excess contributions tax are correctly applied.

You don't have to acknowledge the notice if the value of the relevant super interest on the day you received the notice is less than the tax that would be payable by you for the contribution.

If the member claiming the deduction has made an error with their notice of intent to claim a deduction, the notice can be varied (including varied to nil). Generally they need to do this by the same deadline as the original notice. After this, the notice can't be varied unless: