How and when CGT is triggered, such as when an asset is sold, lost or destroyed.

When you dispose of an asset that is subject to capital gains tax (CGT), it is called a CGT event. This is the point at which you make a capital gain or loss.

Common disposals that will trigger a CGT event include:

The type of CGT event that applies to your situation may affect:

Selling or disposing of an asset will trigger a CGT event and you may have a capital gain or capital loss.

If there is a contract of sale, the CGT event happens when you enter into the contract. For example, if you sell a house, the CGT event happens on the date of the contract, not when you settle.

If there is no contract of sale, the CGT event is usually when you stop being the asset's owner. For example, if you sell shares, the CGT event happens on the date of sale.

In June 2022, Sue entered into a contract to sell land she owned.

The contract settled in October 2022.

Sue made the capital gain in the 2021–22 income year (the year she entered into the contract), not the 2022–23 income year (the year settlement took place).

Your capital gain or loss for an asset is usually the selling price less the original cost and certain other costs associated with acquiring, holding and disposing of the asset.

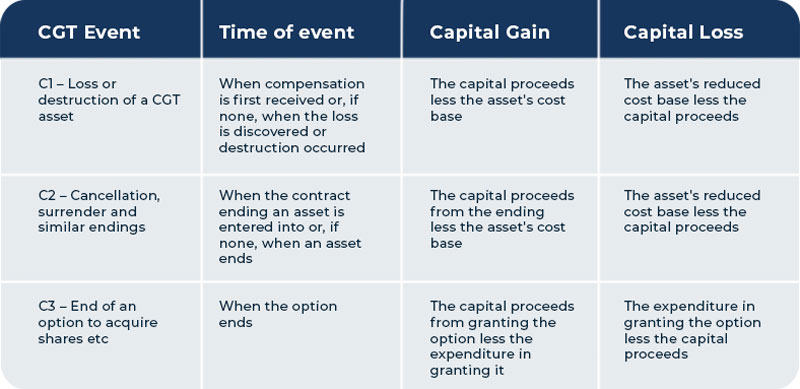

If your CGT asset is lost, stolen or destroyed:

If you do not receive any compensation, the CGT event happens when the loss is discovered or the destruction occurred.

If you replace the asset with a similar asset, you may be able to defer (or 'roll over') your capital gain until another CGT event happens, such as selling the replacement asset.

Laurie's rental property was destroyed by fire in June 2022.

He received compensation under an insurance policy in October 2022.

The CGT event happened in October 2022 when he received the compensation.

Christine owned a rental property that was damaged by floods in May 2022.

The local council deemed the property uninhabitable in August 2022. The property was demolished in November 2022 and Christine did not receive any compensation.

The CGT event happened in May 2022 when the damage happened.

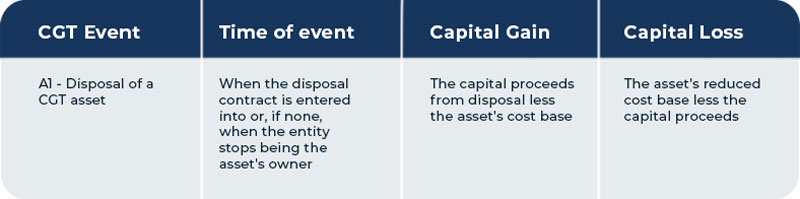

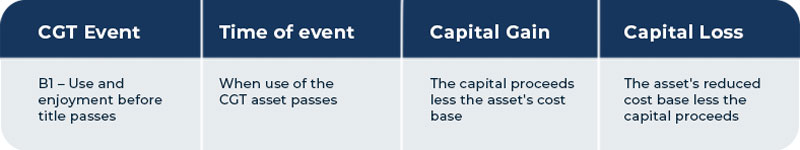

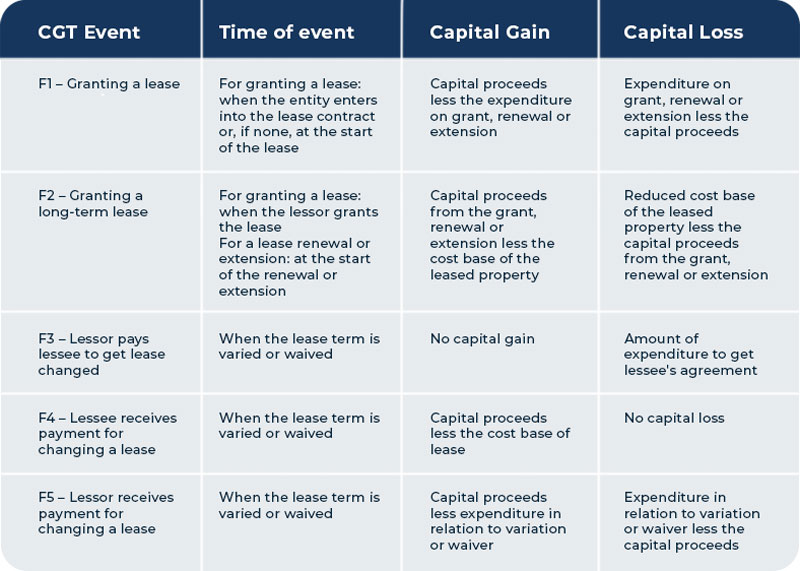

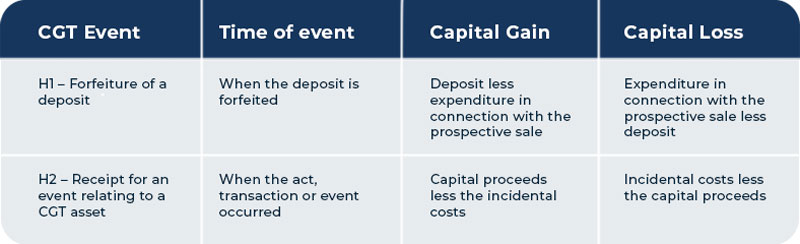

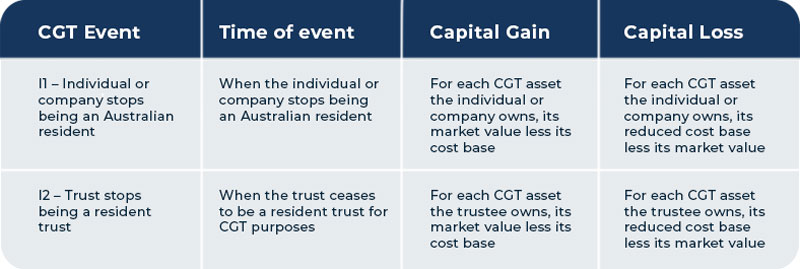

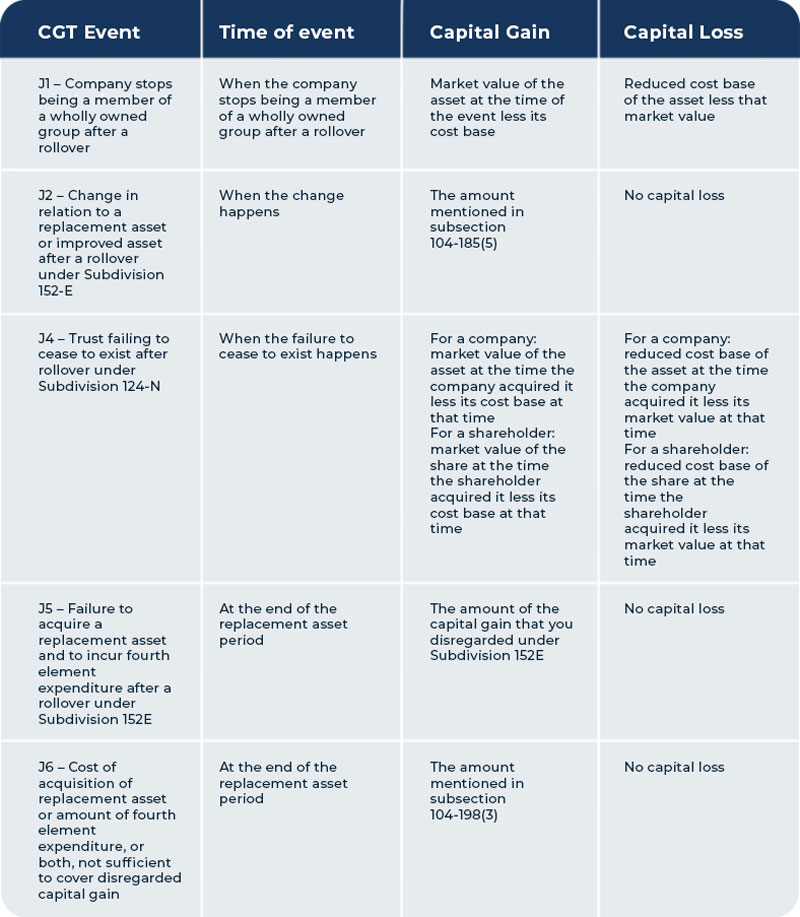

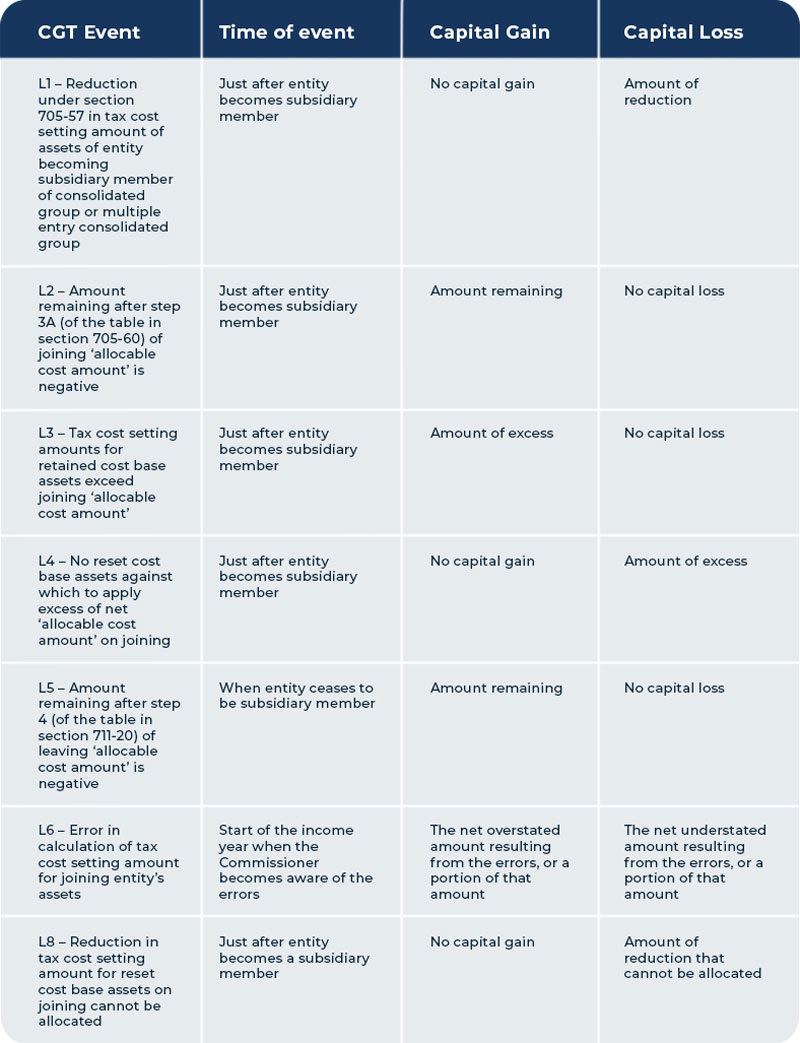

All CGT events are listed below.

If more than one CGT event happens, you apply the rules for the one that best matches your situation.

For more information about the CGT events listed below see Division 104 of the Income Tax Assessment Act 1997.