A move is gathering pace throughout the Commonwealth to provide for a more modern perpetuity period for trust estates.

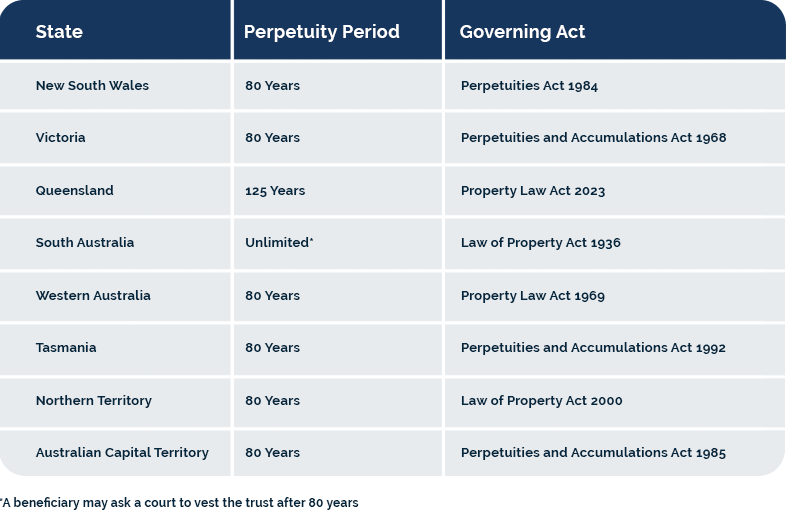

At present most States have introduced legislation prescribing a fixed perpetuity period.

The United Kingdom has decided to replace the current 80-year perpetuity period with a longer 125-year period. The Perpetuities and Accumulations Act 2009 came into force on 5 April 2010. Trusts established from 6 April 2010 are the subject of a 125-year perpetuity period. The United Kingdom realised that the old 80-year period was too short in modern society with people living longer.

Following on from the United Kingdom the New Zealand Government traduced introduced the Trusts Act 2019. This Act extended the perpetuity period of trusts created in New Zealand from 80-years to 125-years. It followed the UK legislation. Queensland has recently introduced the Property Law Act 2023 which extends the perpetuity period for trusts under the law of Queensland to 125-years.

In South Australia section 61 of the Law of Property Act 1936 abolished the perpetuity period. Section 62 of the Law of Property Act 1936 provides that, after 80-years, on an application by a beneficiary or other party the court may cause a trust to vest immediately.

The vesting of a trust may have the following consequences:

The Commissioner of Tax has provided in TR 2018/6 that if the trustee has the power the vesting day of a trust may be extended without any income tax consequences.

Consideration should be given when establishing a trust of where the proper law should be as this will determine the perpetuity period.

Consideration should also be given to whether the proper law of a trust can be changed.

There is also support for this proposition in the South Australian case of Clark v Ebdon [2020] SASC 27 where court upheld the trustee’s application to vary a trust deed concerning the property in NSW to change the proper law of the trust be the law of South Australia. Whilst the issue was decided on the basis of differing consideration relating to s 13 of the Perpetuities Act (NSW) 1984 (‘Perpetuities Act’), the acceptance of the proposition that a trust governed by South Australian law escapes the NSW rule of perpetuities, is inherent in the court’s reasoning